® Volume 24 Number 4 - April 2024

03. Guest comment

Thure Cannon, President, Texas Pipeline Association.

05. Pipeline news

Contract news and an update on the Iran-Pakistan gas pipeline project.

KEYNOTE: COMPLIANCE AND STANDARDS

09. Unveiling the blind spot

Paul Stockwell, Managing Director, Process Vision, describes how current standards fail to detect liquid carryover in gas processing.

15. The power of proactivity

Phanindra Kanakamedala and Greg Morrow, Emerson, USA.

DAMAGE AND DEFECT ASSESSMENT

21. Evaluation of growing corrosion

Fadillah Syahputra, Zugao Chen and Tim Zhang, Deyuan Pipeline Technology Co., Ltd, China.

25. Detecting a pipeline pulse Simon Bell, iNPIPE PRODUCTS, UK.

INTEGRITY AND INSPECTION

29. New approach to pipeline detection

Luigi Kassir and Josh Pendleton, Skipper NDT.

COATINGS AND CORROSION

33. Setting new standards for epoxy coatings

Glen Grundberg, General Manager of Denso North America Inc., Canada (a member of Winn & Coales International Ltd).

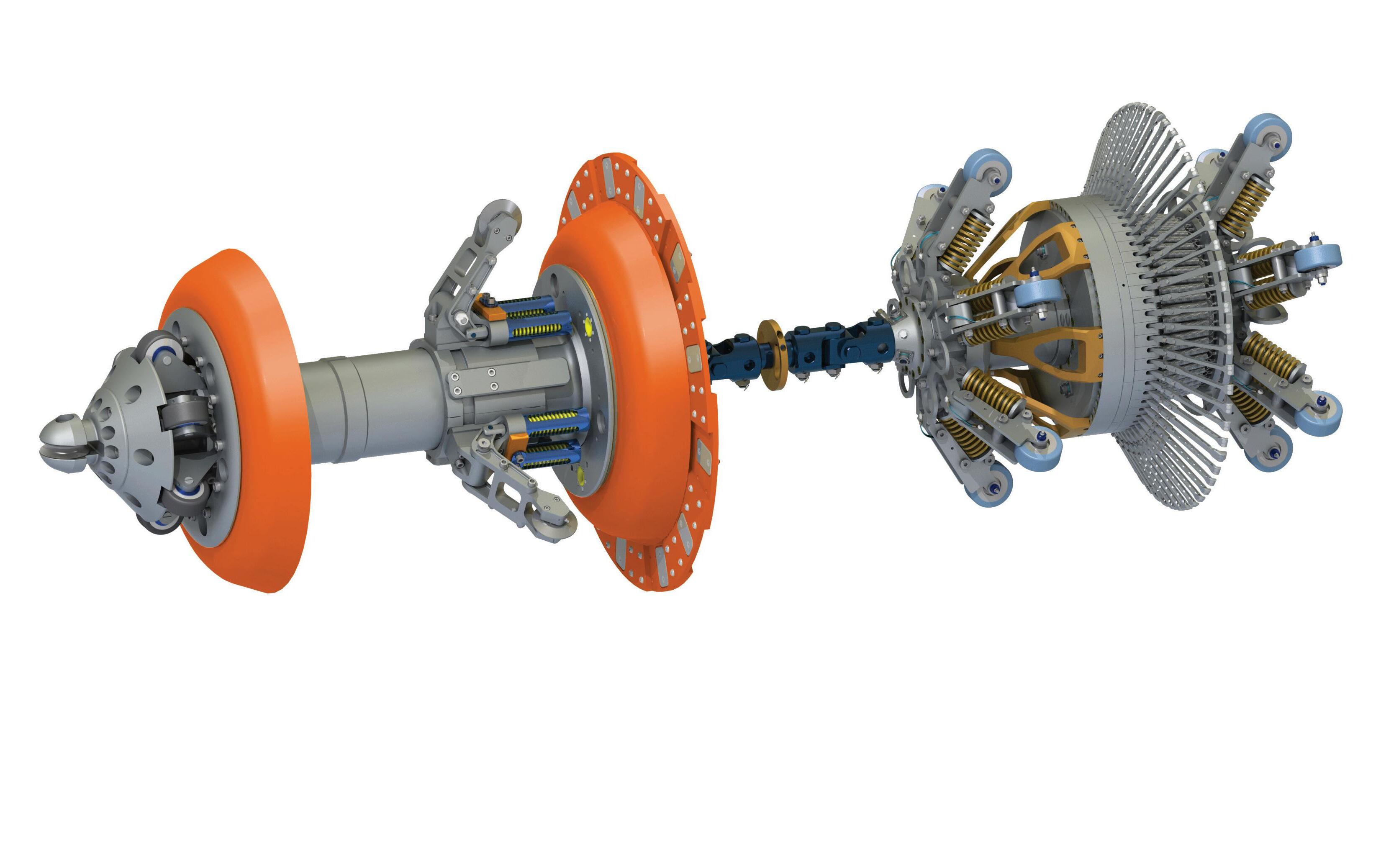

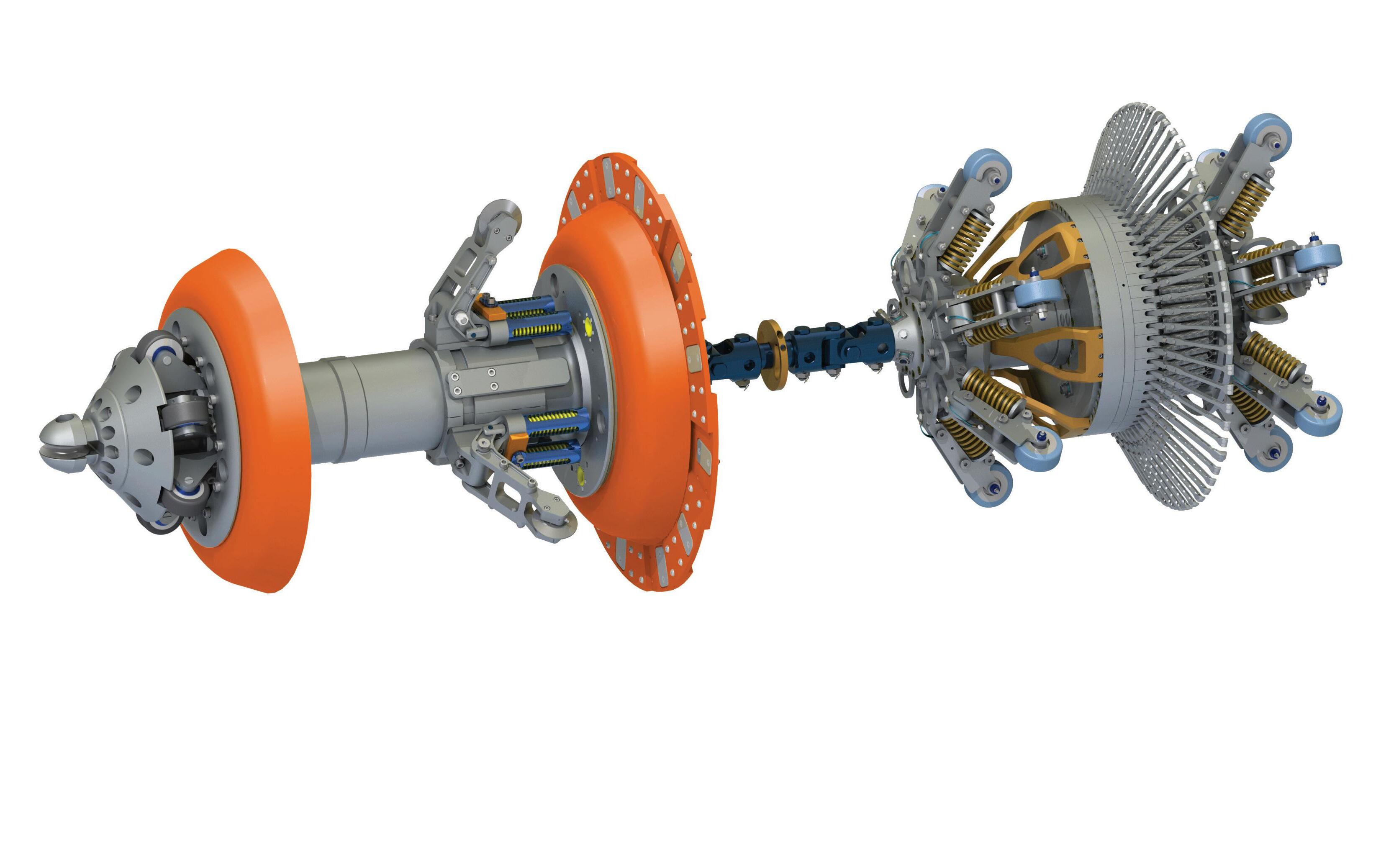

HOT TAPPING AND LINE STOPPING

39. Not just another weld

Frede Maxwell, Brian Anderson, Paul Gonzales, Darren Sutherland, Bie Cornell and Dave Albertson, WeldFit.

CATHODIC PROTECTION

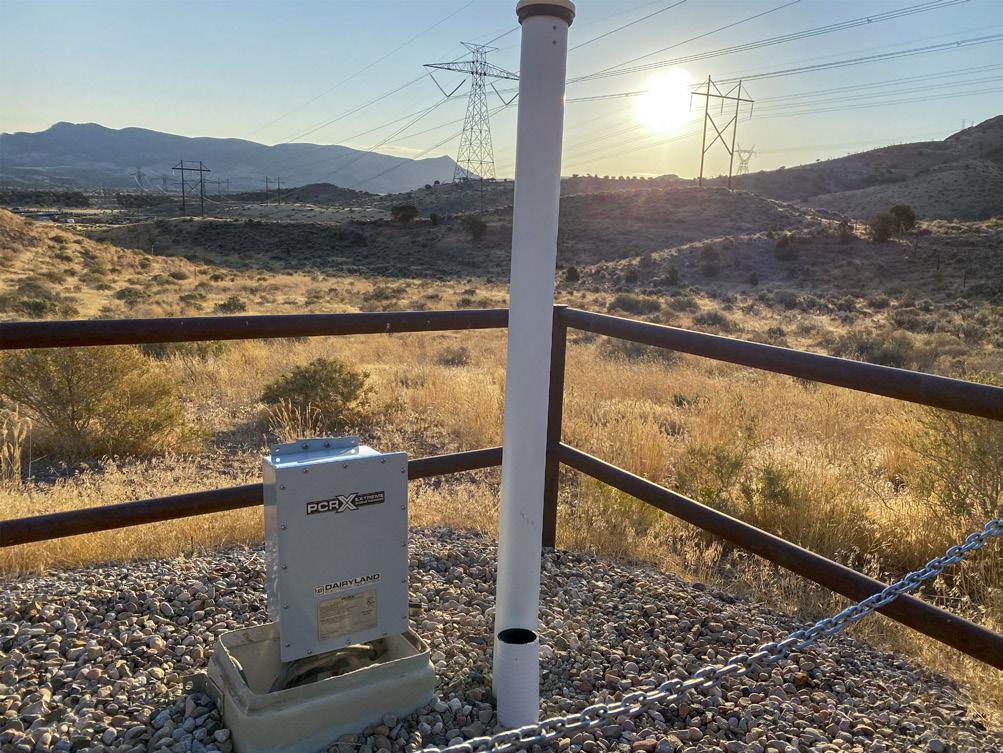

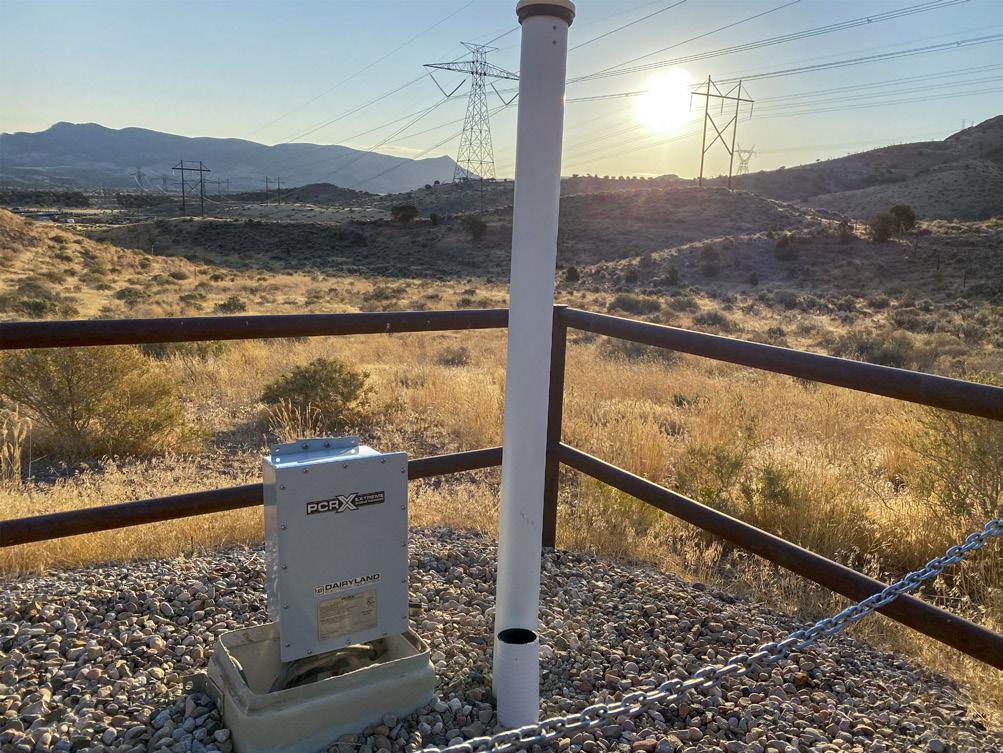

45. Decouplers making a difference

Jay Warner, Dairyland Electrical Industries, USA.

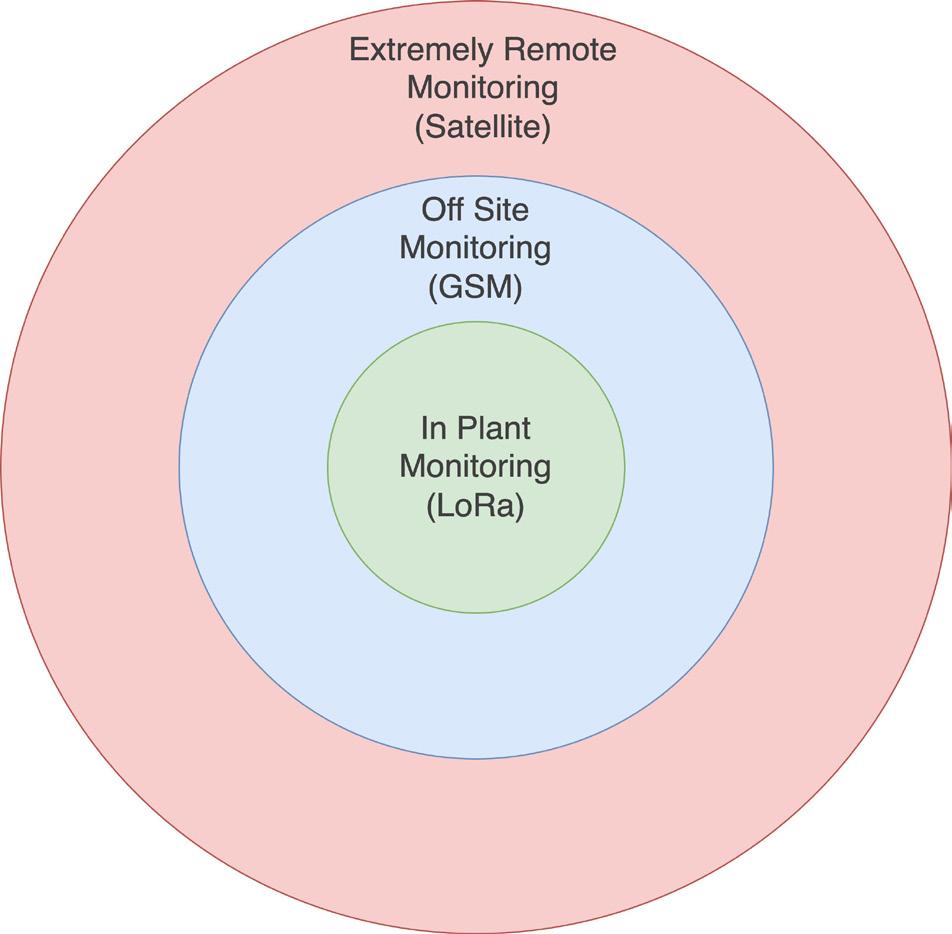

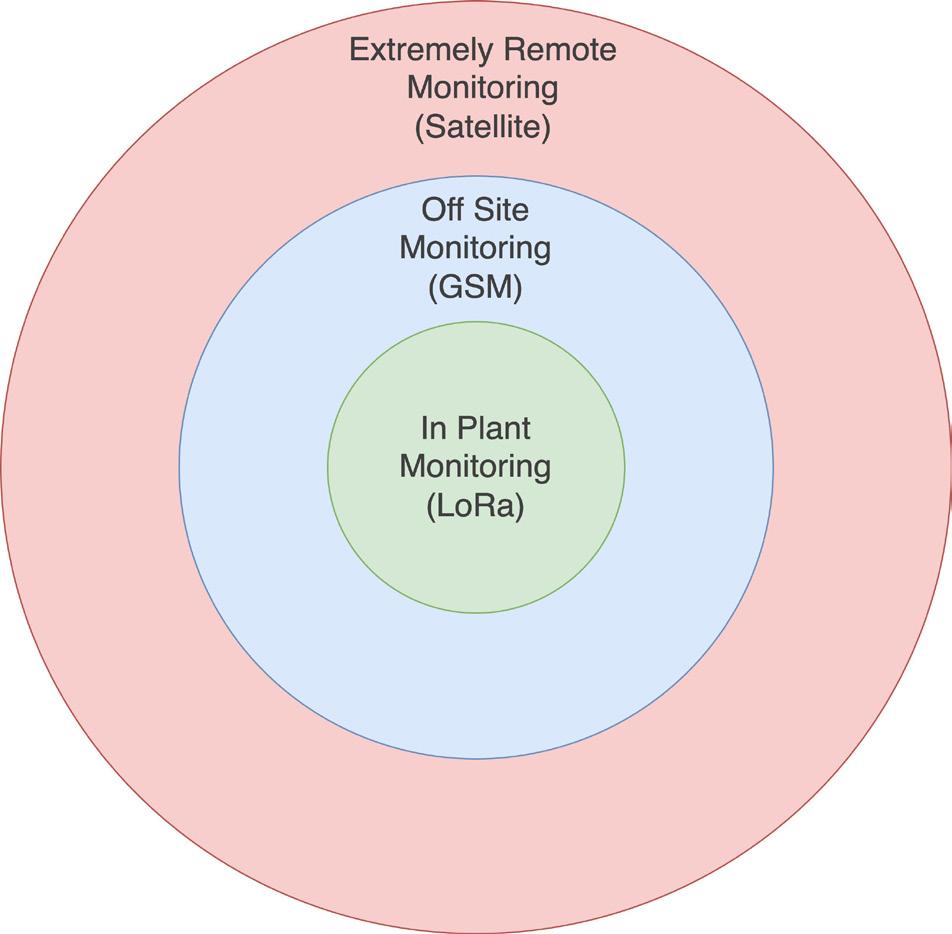

50. The ranges of CP monitoring

David Celine, Managing Director, Omniflex.

HDD

55. Ramming home trenchless technology

Anne Knour, Tracto Technik, Germany.

PIPELAYING AND VESSELS

61. CO2 systems, studies and solutions

Alessandro Terenzi, Giorgio Arcangeletti, Enrico Bonato, Elvira Aloigi, Lorenzo Maggiore, and Annalisa Di Felice, Saipem S.p.A.

OFFSHORE AND SUBSEA

68. Deriving value from offshore data

Neil Skene, Imrandd Ltd, UK.

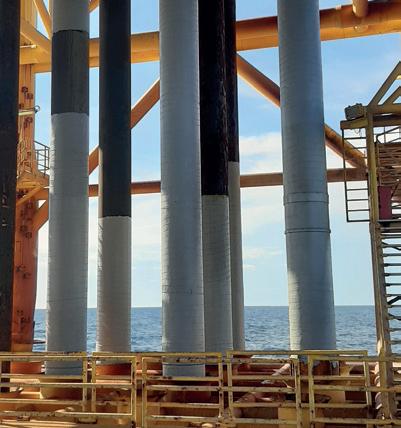

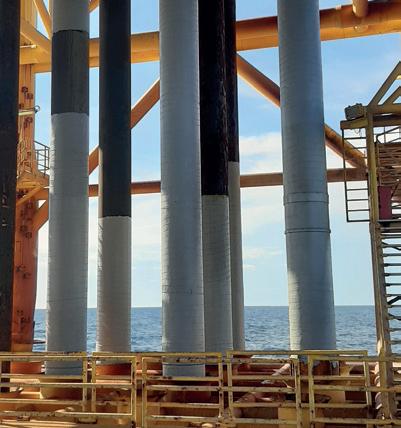

ISSN 14727390 Member of ABC Audit Bureau of Circulations ON THIS MONTH'S COVER Reader enquiries [www.worldpipelines.com] C O NTENTS Copyright© Palladian Publications Ltd 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK. WORLD PIPELINES | VOLUME 24 | NUMBER 04 | APRIL 2024 Founded in 1990, 3X ENGINEERING (3X) is a global leader in critical industrial assets repair using composite technology. Developer, manufacturer, seller and installer of our products we offer to our clients a complete integrated service. From our head offices in Monaco, we operate worldwide, in any environments (Onshore, Offshore and Subsea), thanks to our large qualified distribution network of over 60 partners. For more information, visit www.3xeng.com.

45 CBP019982 25 ® Volume 24 Number 4 - April 2024

PAGE 68 61

PAGE 50

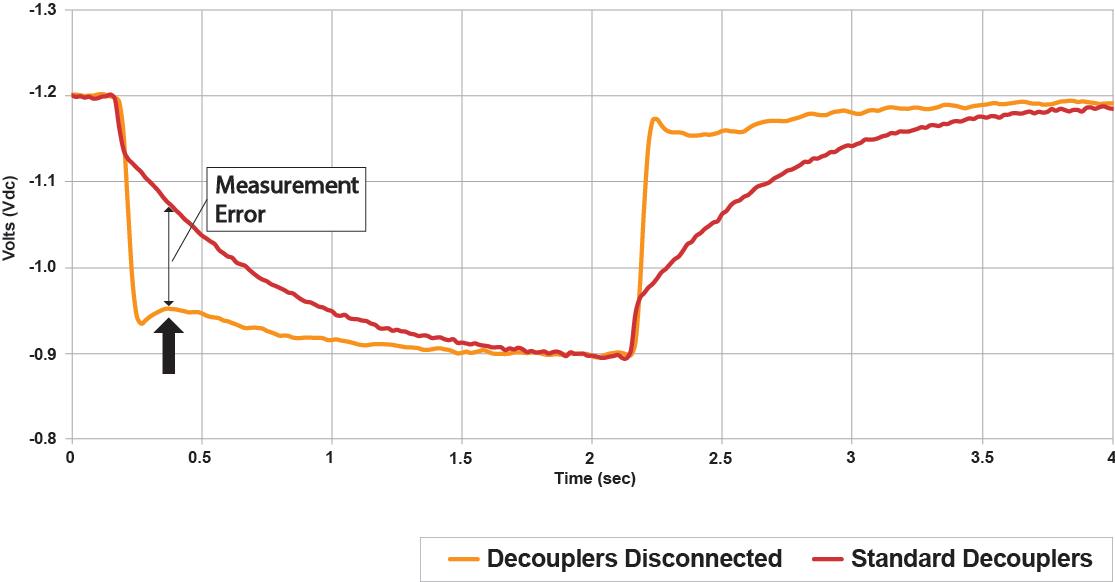

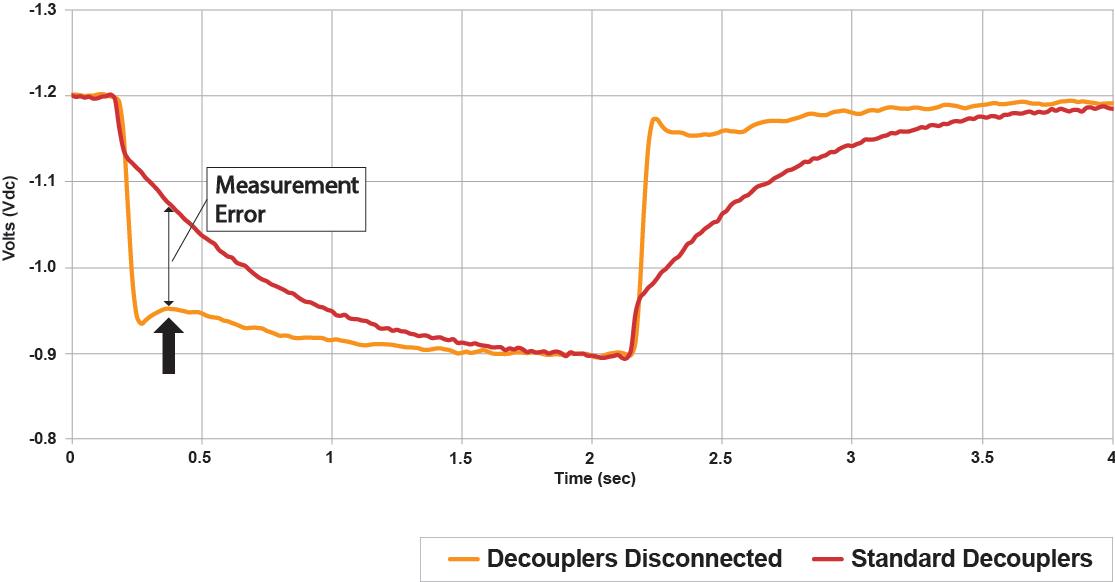

ranges of CP monitoring Industrial pipelines, which are under constant threat from corrosion, are critical pieces of infrastructure that must be occur. However, engineers and asset managers regularly face challenges in monitoring CP systems in pipeline applications Here David Celine, Managing Director of remote monitoring specialist Omniflex, explains why, in plant environment, engineers and plant managers should opt for short range system performance and pipeline corrosion levels. CP systems come in two main forms: galvanic CP and where buried or submerged steel structure connected to metal alloy with more negative electrode potential than it, cell, and the metal alloy becomes sacrificial anode that is consumed by corrosion, rather than damaging the structure. have fully corroded, ensuring ongoing protection. In ICCP systems, current externally injected into the structure to ensure that the structure remains cathodic with anodes that are connected to DC power source by way of transformer/rectifier (T/R), which is normally powered by the David Celine, Managing Director, Omniflex, explains why engineers should opt for short range wireless technology to monitor ongoing CP system performance and pipeline corrosion levels. 50 51

The

GUEST COMMENT

Natural gas – transported safely and efficiently by pipelines – delivers the products we need and use every single day. Recent political developments in the US, however, may threaten the country’s – and our allies’ – energy security, as well as the development of the cleanest and most reliable natural gas industry in the world.

The Texas Pipeline Association (TPA) is the largest state trade association in the US representing solely the interests of the intrastate pipeline network. Its midstream member companies deliver the large quantities of natural gas, crude and the refined petroleum products that are in just about every item on the market today, including plastics, medicines and clothing. These are products the state, the nation and the world cannot do without.

In addition, the Texas oil and natural gas industry is an economic powerhouse. In 2023, it paid state and local taxes and state royalties totalling US$26.3 billion, equating to more than US$72 million each day.1 And in FY 2023, the industry employed 480 176 Texans. Since 2007, the Texas oil and natural gas industry has paid more than US$230.3 billion in state and local taxes and state royalties. No other single industry in Texas can claim anything close to such impressive statistics.

However, the Biden Administration recently froze LNG export permitting

to non-free trade agreement countries, threatening our energy, economic and national security, while providing no major environmental benefits. Along with 31 other state and national oil and natural gas and business organisations, TPA wrote to Biden’s Department of Energy Secretary Jennifer Granholm this past January to argue that restricting LNG exports “puts American jobs and allies at risk, while undermining global climate controls.”

The letter warned that the pause would undercut Biden’s own commitment to supplying American allies with reliable energy. “While our European allies have made significant strides in reducing their reliance on Russian natural gas thanks to American energy producers, Europe faces a considerable supply gap over the longterm that should be met by American energy, not hostile nations,” the letter said. In late March, 16 states, including Texas, sued the federal government over its ban on LNG permits.

The LNG pause is just one more example of the current federal interference that threatens Texas’s vaunted innovation, development and growth of a natural gas and infrastructure system that is the envy of the world. To understand why the state’s market-driven approach is so successful, it is vital to understand the difference between interstate and intrastate pipelines.

There are approximately 489 657 pipeline miles in the state, of which 439 922 are intrastate.2

The intrastate industry is regulated primarily by the Railroad Commission of Texas (RRC) and is based on a freemarket system that is designed to ensure a safe, affordable and abundant supply of energy. Prices are set by market forces. Neither the RRC, the state of Texas nor any state or federal agency has the power to set the price of natural gas.

The Texas intrastate market is an independent competitive market that

allows pipelines to be built when there is sufficient market demand. Pipelines can begin construction once the permit is approved (often in less than a year) and ultimately are built in a timely manner to meet ever-increasing demand. Transportation rates are negotiated between shippers and pipeline companies.

Conversely, at the federal level, the Federal Energy Regulatory Commission (FERC) regulates interstate pipes and determines if new interstate pipelines are necessary, whether they can be constructed, their location and the maximum rate of transportation based on cost-of-service. New pipelines can only be built after these determinations have been made, often taking years and thus restricting access to abundant natural gas.

This excessive federal involvement causes major slowdowns during the building of new infrastructure at a time when demand for power in the US is at its highest and continues to grow.

Instead, our market-based system has delivered tremendous success in a state where Texas legislators have worked diligently to keep energy prices low and supplies abundant – just one of the reasons why the population and economy is booming.3 The state is now the nation’s second most populous – and the number of energy-hungry businesses that have moved to the state continues to grow. Consumers win as well, with the state boasting some of the lowest energy costs in the nation.

Left unfettered by unnecessary regulation, Texas wins, along with our European allies and global emission goals, as we continue to produce and deliver some of the safest, most reliable and efficient natural gas and hydrocarbons in the world. 1.

2023 Annual Energy & Economic Impact Report, TXOGA, January 30, 2023.

Texas Pipeline System Mileage, Railroad Commission of Texas; 2024.

US Census Bureau, Texas population.

2.

3.

THURE CANNON President of the Texas Pipeline Association (TPA)

The experts you can trust CRC Evans’ market-leading welding and coating services, technologies and equipment ensures efficient, on-time delivery of your global onshore and offshore energy projects. Americas Europe Middle East Africa Asia Pacific crcevans.com enquiries@crce.com @crcevansglobal

WORLD NEWS

EQT agrees to buy Equitrans Midstream

US natural gas producer EQT Corp has agreed to buy Equitrans Midstream in an all-stock deal that values its former pipeline unit at about US$14 billion including debt, as companies look to navigate decade-low prices for the commodity, reports Reuters.

Merger activity in US shale oil and gas has soared in pursuit of greater scale and cost efficiencies amid volatile prices, with US$250 billion in deals in the oil and gas industry in 2023.

The combination will allow EQT to lower costs to produce and transport its natural gas to market by adding more than 2000 miles of pipelines, the companies said on Monday.

“The only way to truly thrive in this world is to be at the low end of the cost curve,” EQT Finance Chief Jeremy Knop said on a conference call with analysts.

But investors were unimpressed by the combined company’s US$13.4 billion in debt and US$250 million a year in

potential synergies. EQT shares fell 8% to US$34.53 while Equitran rose 2.7% to US$11.55 in midday trading. At the current price of EQT, the offer would be valued at US$12.10 per share.

“While operationally we like the combination, the deal adds an equity overhang as midstream holders may have different priorities, and the incremental debt likely directs EQT’s free cash flow to leverage reduction over all other options for the near-term, which we expect to result in the shares trading down,” said Bertrand Donnes, analyst at Truist Securities.

A global gas glut has pummelled prices, forcing producers to curb output and spending on drilling activity. EQT, which has been an aggressive consolidator, is curtailing nearly 1 billion ft³/d of natural gas production this month.

The deal is expected to help lift margins by gaining better control of pipeline costs and processing as EQT pushes to get global prices via greater exposure to LNG export markets.

PHMSA opens US$18 million funding opportunities for pipeline and safety activities

The US Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA) has published multiple Notices of Funding Opportunities (NOFOs) to award US$18 million in grants through its pipeline and hazardous materials safety programmes.

These funding opportunities are open to states, local communities, tribal entities, universities, and non-profit organisations to support pipeline and hazardous materials safety programmes across the USA.

First phase of Iran-Pakistan gas pipeline approved

The Pakistan Ministry of Energy has announced the approval of the first phase of the Iran-Pakistan (IP) gas pipeline by the Cabinet Committee on Energy (CCoE).

The decision, which comes after approximately 10 years of postponement, is set to enhance the nation’s energy security.

During its recent session, the CCoE considered a summary from the Petroleum Division regarding the IP Gas Pipeline. The committee endorsed the recommendations of the Ministerial Oversight Committee for the project, which was established by caretaker Prime Minister Anwaar-ul-Haq Kakar in September 2023.

Funding will be used to improve community and environmental safety through projects that train first responders, educate the public on local safety initiatives, encourage the development of new pipeline technologies, and more.

“Local authorities and emergency responders are often the first on the scene after a pipeline or hazmat transportation incident, and the Biden-Harris administration is proud to support them with additional training and resources,” said US Transportation Secretary Pete Buttigieg.

The approved work includes the construction of an 80 km section of the pipeline within Pakistan, extending from the border to Gwadar. The pipeline will bring natural gas from Iran’s South Paras Gas field.

Inter State Gas Systems will execute the project, with funding sourced from Gas Infrastructure Development. Iran has set a 180 day deadline for Pakistan, expiring in September 2024, to begin the pipeline’s construction, according to reports.

The 781 km pipeline, which is due to run from the Iranian border to Pakistan’s port city of Gwadar, will have estimated capacity of 750 million ft3/d to around 1 billion ft3/d.

GlobalData: pipelines set to dominate US oil and gas midstream projects

The trunk/transmission pipelines segment is set to dominate upcoming oil and gas midstream projects in the US by 2028, accounting for about 47% of the midstream projects starting between 2024 and 2028, says GlobalData, a leading data and analytics company.

GlobalData’s latest report, ‘North America Oil and Gas Projects by Development Stage, Capacity, Capex, Contractor Details of All New Build and Expansion Projects to 2028,’ reveals that 186 midstream projects are expected to start operations in the US during the period 2024 – 28. Out of these, the trunk/ transmission pipelines segment alone constitutes 87 projects, followed by gas processing and LNG with 34 and 29, respectively.

Bhargavi Gandham, Oil & Gas Analyst at GlobalData, comments: “The midstream sector in the US continues to grow

due to rising production from shale plays, necessitating infrastructure expansion for transportation and storage. Rising exports of oil and gas are providing additional momentum to the sector’s growth.”

Among the upcoming transmission pipeline projects in the US by 2028, WEST Header Project is a key project with a pipeline length of 1046 km. To be operated by Magnum Development LLC, the natural gas pipeline project is expected to commence operations in 2028.

Gandham concludes: “The US boasts one of the world’s most extensive oil and gas transmission pipeline networks, with plans for new pipelines, particularly in natural gas, aimed at lowering domestic carbon emissions and facilitating LNG exports.”

APRIL 2024 / World Pipelines 5

EVENTS DIARY

8 - 11 April 2024

CONTRACT NEWS

DeepOcean to inspect pipelines for Equinor

Pipeline Technology Conference (ptc) 2024

Berlin, Germany

www.pipeline-conference.com

15 - 19 April 2024

TUBE Düsseldorf 2024

Düsseldorf, Germany

www.tube-tradefair.com

6 - 9 May 2024

Offshore Technology Conference (OTC) 2024

Houston, USA

www.2024.otcnet.org

11 - 13 June 2024

Global Energy Show 2024

Calgary, Canada

www.globalenergyshow.com

26 - 27 June 2024

Hydrogen Technology Conference & Expo 2024

Houston, USA

www.hydrogen-expo.com

26 - 29 August 2024

ONS 2024

Stavanger, Norway

www.ons.no

9 - 13 September 2024

IPLOCA convention

Sorrento, Italy

www.iploca.com/events/annual-convention

17 - 20 September 2024

Gastech 2024

Houston, USA

www.gastechevent.com

24 - 26 September 2024

International Pipeline Conference & Expo (IPE) 2024

Calgary, Canada

www.internationalpipelineexposition.com

Ocean services provider DeepOcean has been awarded a contract by Equinor to deliver pipeline inspection and survey scopes on the operator’s pipelines in the North Sea.

In addition to its extensive infield pipeline networks, Equinor also has operational responsibility for the world’s most extensive subsea pipeline system for transportation of gas.

DeepOcean’s scope of work includes pipeline inspections, seabed mapping, and ad-hoc pipeline survey and light construction work. The agreement is valid for 2024.

The latest contract is an additional award under DeepOcean’s frame agreement with Equinor for the provision of offshore survey services. DeepOcean has not

Corinth Pipeworks to be CO2 pipe contractor

Corinth Pipeworks has been selected as a contractor by Northern Endurance Partnership (UK), for an offshore pipeline to transport and store millions of t of carbon dioxide (CO2) emissions safely in the UK North Sea to an offshore geological storage site named the Endurance Store.

Northern Endurance Partnership (NEP), a joint venture between bp, Equinor, and TotalEnergies, is the CO2 transportation and storage provider for the East Coast Cluster (ECC).

The infrastructure will serve the Teessidebased carbon capture projects – NZT Power, H2Teesside and Teesside Hydrogen CO2 Capture. NEP aims to support the UK’s net-zero commitments by developing the world’s first zero-carbon industrial hub by 2030.

LIBERTY Steel selected for UK carbon capture pipeline contract

LIBERTY Steel has announced that its Hartlepool pipes division has been selected for a major contract to supply pipelines to the key UK energy infrastructure development by Northern Endurance Partnership (NEP) and Net Zero Teesside Power (NZT Power) making significant cuts to UK carbon emissions.

LIBERTY Pipes Hartlepool (LPH) will deliver onshore and offshore linepipe to the Teessidebased project, one of eight EPC packages awarded with a combined value of around £4 billion.

disclosed the value of the new contract.

“We are proud to continue to support Equinor with subsea services in the North Sea. We will utilise the vessel Edda Flora with our Superior Survey ROV to perform the survey work,” says Trond Hagland, Commercial Manager – Survey and Inspection at DeepOcean.

The Superior Survey ROV provides unmatched ROV survey performance. Its hydrodynamic shape, power and modular design provides excellent operational versatility and data quality. The ROV is equipped with the latest navigation and sensor system technologies.

DeepOcean will manage the contract delivery out of its headquarters in Haugesund, Norway, supported by the company’s operation in Aberdeen, UK.

6 World Pipelines / APRIL 2024 Follow us on LinkedIn to read more about the articles linkedin.com/showcase/worldpipelines ON OUR WEBSITE • CEZ to acquire majority stake in GasNet • Decom strengthens position in AsiaPac with three contract successes • Vopak signs agreement with Air Liquide • ABL secures subsea contract for US Gulf of Mexico project • Corcovado Geosub signs contract with Kongsberg Discovery • OPITO launches new global standard for offshore safety

HEAT SHRINKABLE SLEEVES

DENSO™ are leaders in corrosion prevention and sealing technology. With 140 years’ service to industry, our mainline and field joint coating solutions offer reliable and cost effective protection for buried pipelines worldwide.

FOR CORROSION

United Kingdom, UAE & India USA & Canada

Australia & New Zealand Republic of South Africa

www.denso.net

www.densona.com

www.densoaustralia.com.au

www.denso.co.za

PROTECTIVE OUTERWRAPS

LIQUID EPOXY COATINGS

PETROLATUM TAPE WRAP SYSTEMS

SOIL-TO-AIR INTERFACE

BUTYL TAPE WRAP SYSTEMS

INTERNAL PIPE LININGS

BITUMEN TAPE WRAP SYSTEMS

A MEMBER OF WINN & COALES INTERNATIONAL

PREVENTION

VISCO-ELASTIC COATINGS

CUSTOMIZED CALIPER TECHNOLOGIES WITH IMU MAPPING

Rugged

WWW.GEOCORR.COM

Equipment For New Construction & Highly Sensitive Tools For In-Service Pipelines

Liquid carryover in gas processing is a significant problem, leading to limitations on gas flow, production losses and increased operational costs due to foaming, fouling, and chemical usage. Liquid carryover in the export gas from gas processing plants, can also lead to higher maintenance costs and serious safety issues at compressor stations, LNG plants and gas turbine power stations. Traditional monitoring systems often fail to detect this problem, giving a false impression of ‘dry gas’. Permanent monitoring systems for phase separation and filtration are currently inadequate. The industry is now adopting real-time monitoring through process cameras to identify issues like mist or stratified flows, thereby

Paul Stockwell, Managing Director, Process Vision, describes how current standards fail to detect liquid carryover in gas processing.

9

improving the balance between processing trains and reducing costs. Traditional gas sampling systems that adhere to API and ISO standards may miss liquid carryover events, leading to financial losses. New process camera systems can capture these events, improving the validation and uncertainty of fiscal metrics like flow and calorific value.

Liquid carryover in gas processing

A detailed survey by Amine Experts studied 400 cases of amine plant failures, finding that these failures cost operators between US$250 000 and US$250 million each.1 The survey identified three main causes of failure: poor amine quality leading to corrosion; contaminated gas at the inlet causing foaming; and insufficient heat affecting product quality. A notable finding is that two of these main causes – poor amine quality and contaminated gas at the inlet – underline the critical need for better filtration and phase separation at the gas entry stage. Incorrect phase separation was identified as the primary cause (61%) of foaming events.

The survey also points out that many gas plants operate under optimum flowrates to allow a safety ‘margin’ against foaming. Process cameras can bolster operator confidence, enabling them to run plants closer to the optimum flowrates, as these cameras provide real-time data to swiftly deal with issues like foaming.

Issues around liquid carryover were also discussed, particularly during the de-sulphuration and de-humidification stages. This carryover can contaminate subsequent processes like NGL removal.

While effective technologies for tackling these issues exist, they are not widely used, affecting the efficiency of NGL recovery and other downstream processes. Contaminants like glycol, which are difficult to detect, are not currently monitored by any custody transfer analysis but are frequently the most common component produced when lines are pigged and have financial implications for operators.

Compressor damage

The survey by the UK Health and Safety Executive found that the average lifespan of dry gas seals, which are usually labyrinth seals with a 5-micron gap between static and rotating components, was significantly shorter than the five years expected by manufacturers and users.2 The main reason for this discrepancy was found to be contaminated gas. In every case of failure in the study, liquids were discovered between the faces of the seals. These liquids or solids bridge the gap that is otherwise maintained by gas pressure, allowing for increased thermal conduction and compromising the seal gap. Once the seal components make contact, this results in rapid wear, drastically reducing the lifespan of the seal and, in some instances, causing loss of containment. The cost of each failure was significant, ranging from US$60 000 to US$120 000, not including the loss of production.

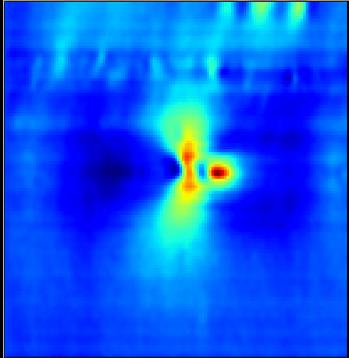

Process cameras

The use of process cameras in high-pressure gas pipelines has revolutionised the way operators understand and manage gas flows. These cameras deliver real-time visual insights

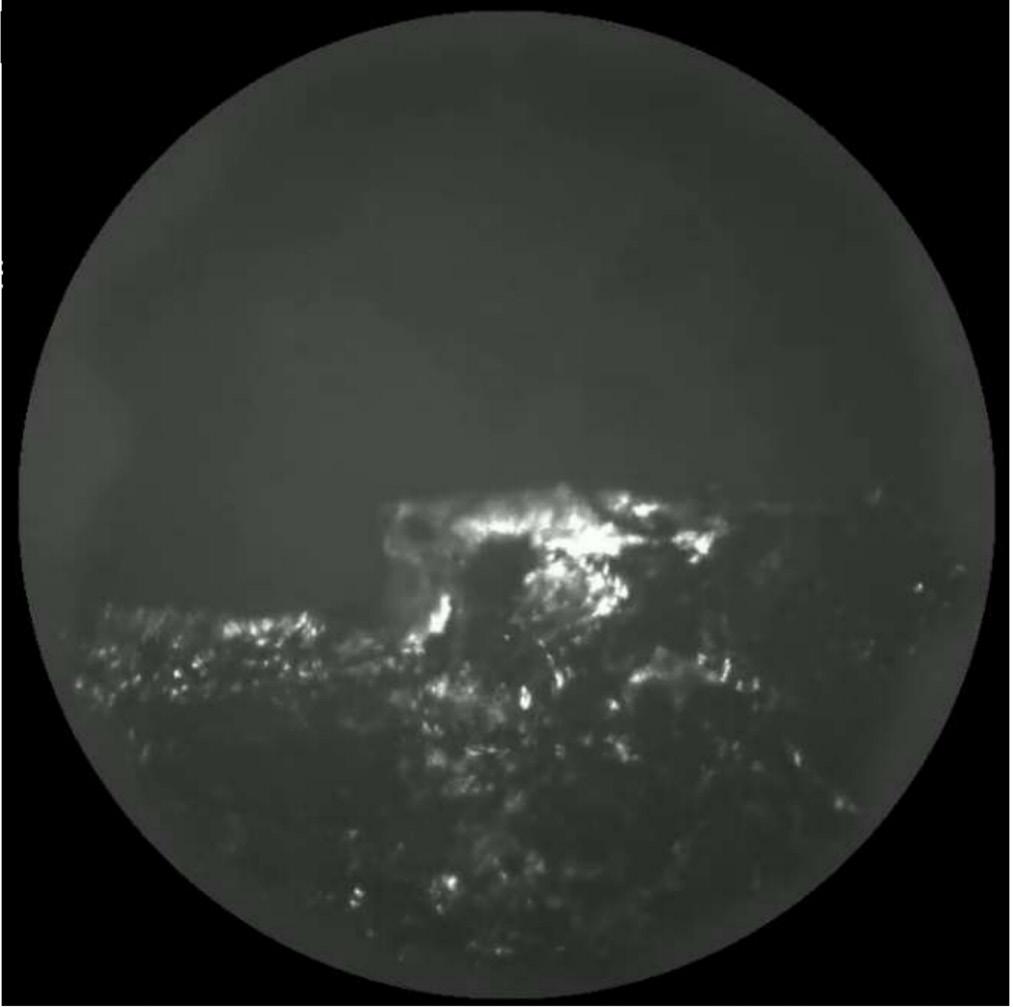

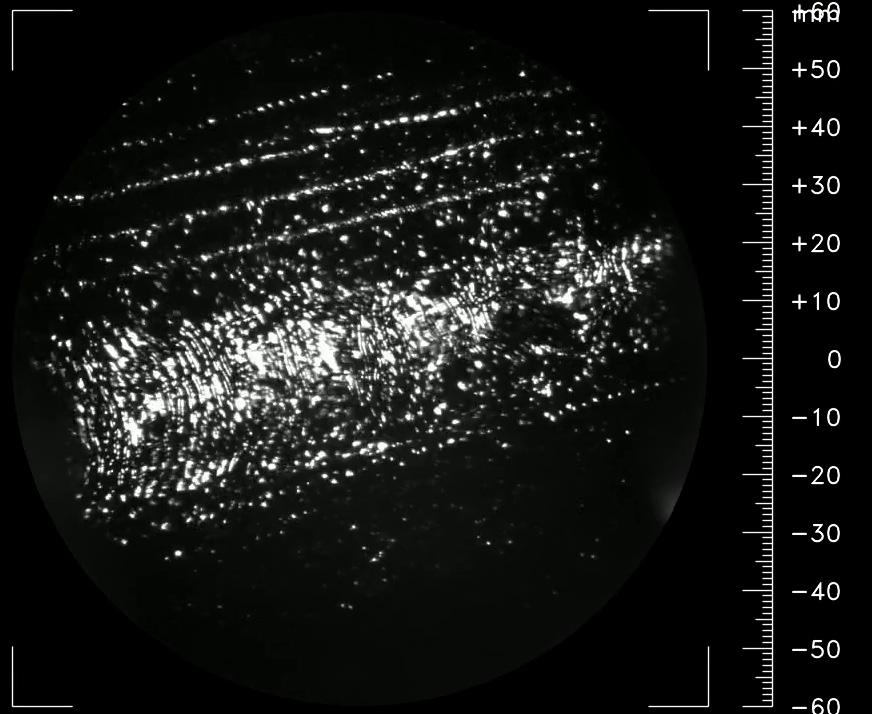

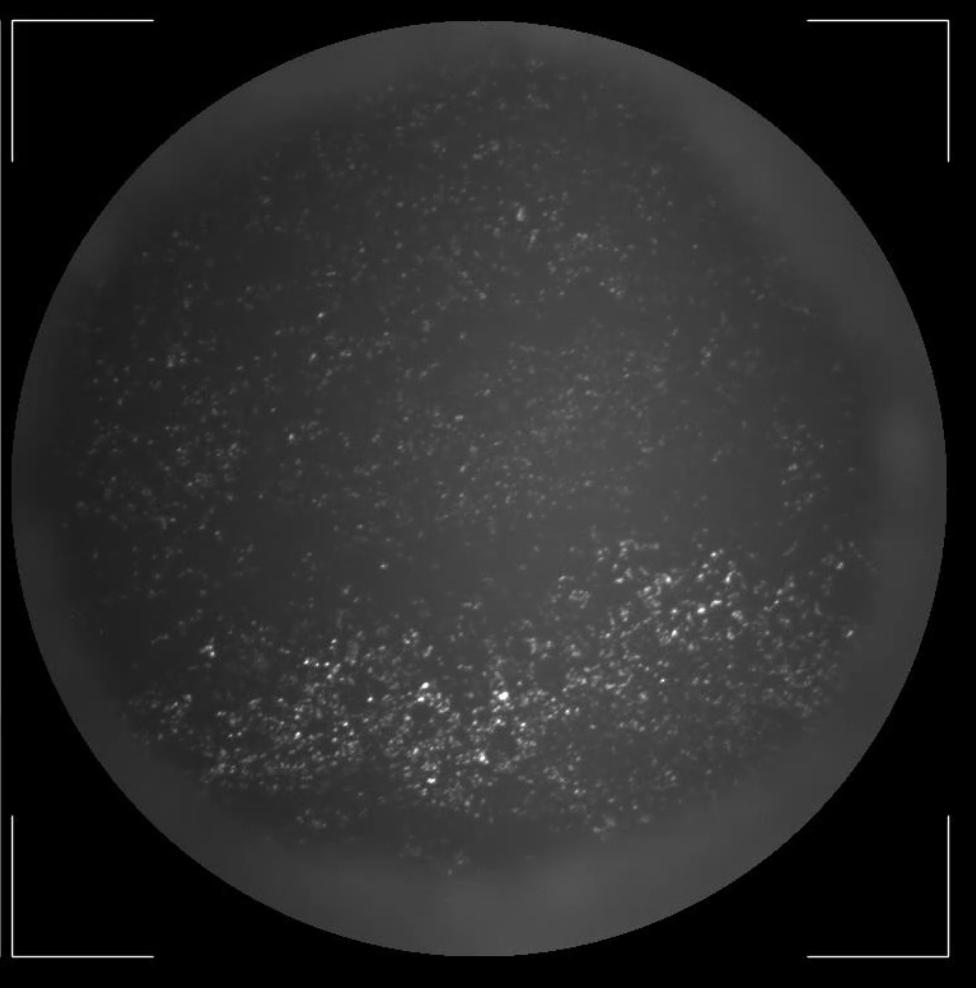

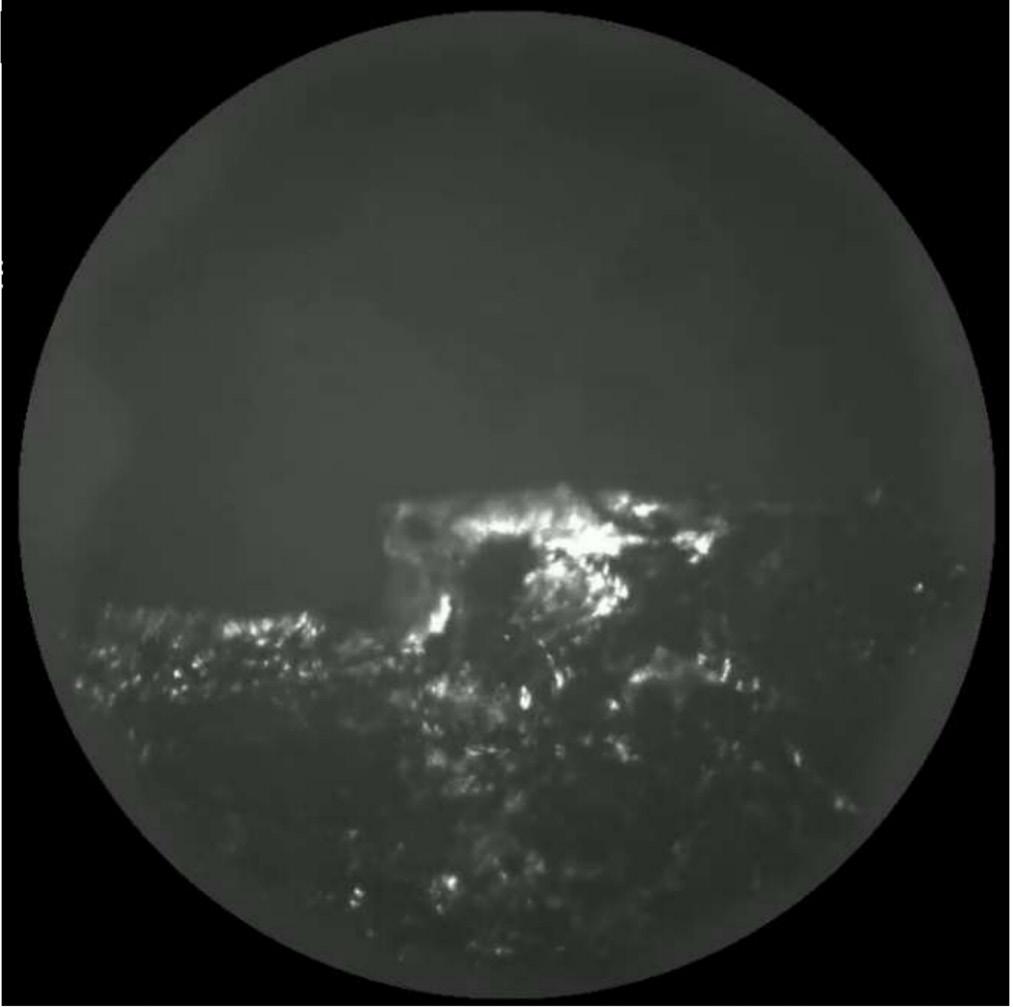

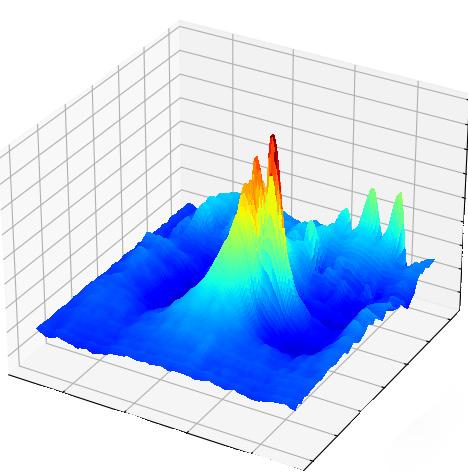

Figure 1. The process camera mounted on the gas pipeline.

Figure 2. Top left – dry gas. Top right – stratified flow of compressor oil. Bottom left – stratified flow of condensate. Bottom right – mist flow.

10 World Pipelines / APRIL 2024

Figure 3. Grease-like contamination.

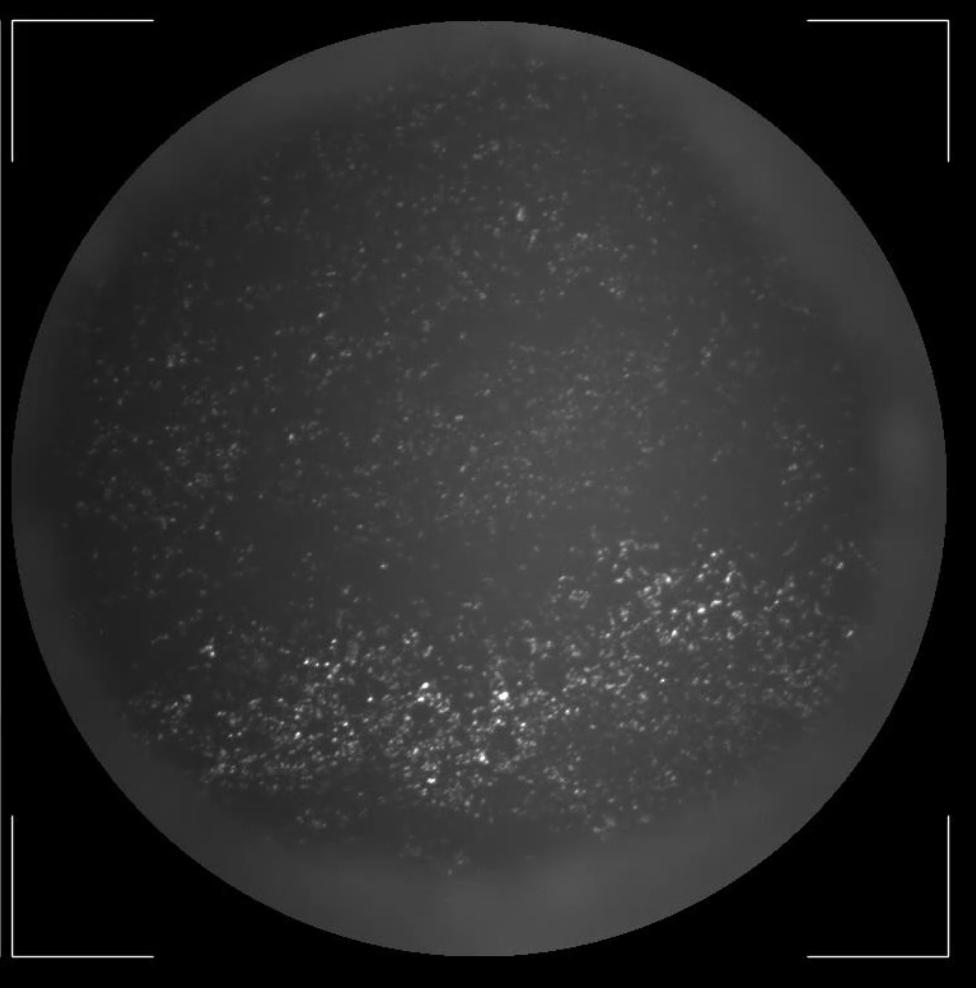

into pipeline activity to process managers and technical resources both onsite and remote. They are revealing that liquids are more commonly present than previously thought. This discovery has significant implications for dry gas flow measurement and gas analysis. The cameras are typically mounted vertically and view through an isolation valve, capturing a plan view of the pipeline floor where liquid streams, solids, and mist flows can be observed (Figure 1).

The live-streamed video feeds into control rooms often indicate the presence of liquid streams even when no other alarms have been activated. The metadata from these videos, such as variations in brightness, can serve as useful indicators for the stability of gas flow and can be used to set alarm thresholds. Advanced machine learning techniques further refine the alarm system by categorising the severity of incidents.

Examples of contaminated gas flows

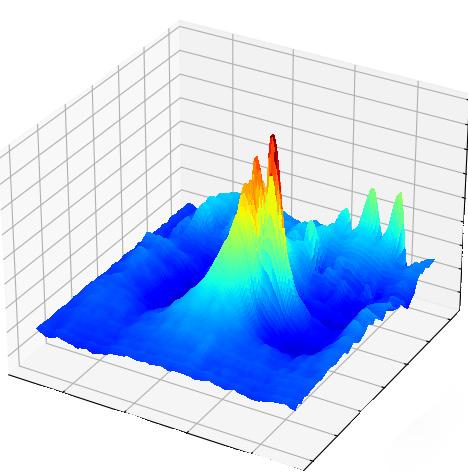

Observations in real-world large diameter gas pipelines with a pressure of around 920 psi have revealed various types of contamination flows. While dry gas flow, stratified flows of compressor oil and condensate, as well as severe mist flows were observed, it’s crucial to note that stratified and mist flows can occur independently and even simultaneously. Contrary to computational fluid dynamic (CFD) models suggest – indicating stratified flows at low gas velocities and mist flows at high velocities – real-world observations have shown both types of flows occurring at varying velocities.

Various parameters, including temperature, liquid density, liquid viscosity, and pipe surface conditions, significantly affect the movement of contaminants in mixed-phase flows. For instance, a mist flow can turn into a stratified flow if there’s a momentary drop in the gas flow. It is also common to observe mist and stratified flows at the same location, either at different times or occasionally simultaneously.

Diurnal changes

Diurnal changes in mist flow are commonly observed in pipelines, with the mist flow increasing during daytime and decreasing at night. This pattern is highly repeatable and independent of absolute temperature and can even lead to the pipe floor being entirely obscured at peak mist flow.

The presence of these repeatable diurnal changes is believed to indicate that a volatile gas, most likely Natural Gas Liquids (NGLs), is present in the pipeline.

Dry material conveyed in a pipeline

In pipelines, grease-like contaminants (Figure 3) can evolve into dry material once gas flow begins. Over time, the rapid gas flow over these materials dries them out, explaining the presence of dry material when lines are pigged. With stratified flows, liquids within the pipeline are moved along due to friction with the gas. As these liquids move, the quicker-moving gas above them progressively dries out the liquid, leaving the denser and solid content. Eventually, this causes the liquid to slow down and come to a stop, where it continues to dry out, becoming stationary material on the pipeline floor.

Liquid separation within the pipeline

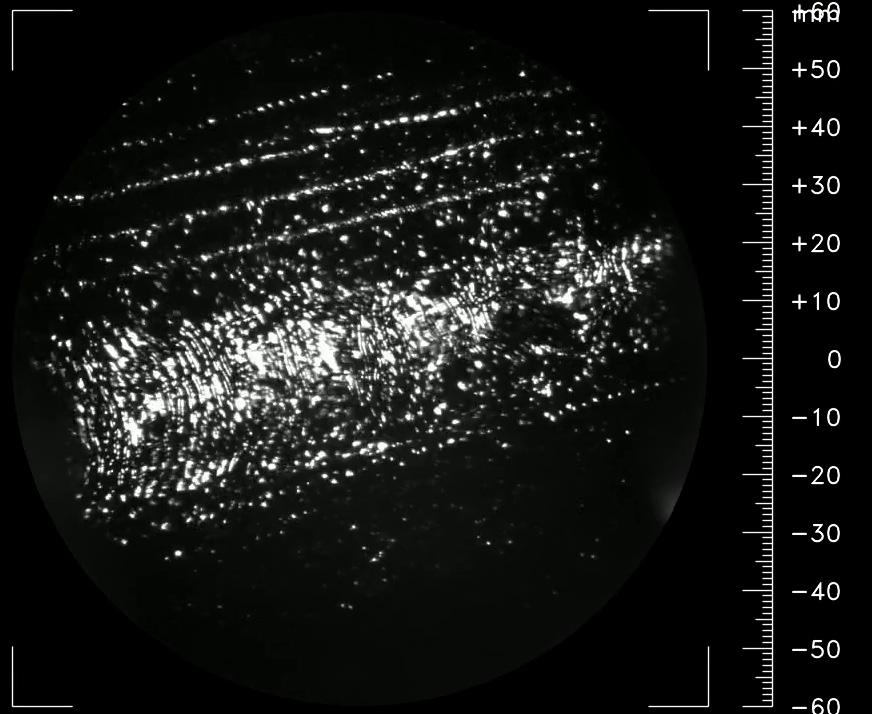

Figure 4 observes a phenomenon in a 36 in. diameter pipeline, showing two stratified flows: a worm-like flow of compressor oil at the top and bottom, and a stream of another liquid in the centre. These liquids of different densities appear to have separated in the pipeline. The gas flow is from left to right, and the liquid flow is angled differently, likely because the installation is near to two 90° bends. This suggests that the twisting gas flow, created by the bends, is influencing the direction of the liquid flow due to friction between the gas and liquid.

Errors in fiscal measurement – calorific value

The importance of accuracy for calorific value measurement and protecting gas chromatographs (GCs) and other gas analysers from liquid contamination is underscored by API 14.1, ISO 10715 and the GPA (Gas Processors Association) data book. These standards recommend the use of stabbing probes or quills for

Figure 4. Duel liquid flow.

12 World Pipelines / APRIL 2024

Figure 5. Material on the pipe floor after a liquid event.

taking gas samples from the middle of the pipeline to avoid wall contamination. Additional membrane or coalescing filters should also be installed between the pipeline’s tapping point and the gas analyser to ensure a representative gas sample and longterm, uninterrupted service is achieved. These precautions have produced major shortcomings:

) Operators remain unaware of wet gas or liquid events in the pipeline. This is problematic as it can result in significant errors in calorific value calculations, sometimes exceeding 40 Btu, during events that can be almost continuous on some flows observed at custody transfer points. This can lead to significant financial losses for the gas producer.

) The standard practice of avoiding and removing any liquids from the sample may produce a false sense of security. Specifically, hydrocarbon (HC) dewpoints calculated from GC data lead operators to believe the gas is much drier than it actually is in the pipeline, leading to higher operational risks of corrosion and compressor failures for transmission system operators.

) Operators are unaware when liquids are present in the pipeline and exceed the gas quality requirements of tariffs and other commercial agreements. This means compliance with gas quality standards is not met.

Installation of process cameras validates the measurements from gas analysers when a single-phase flow is present, and alerts operators to the presence of wet gas or mixed-phase flow, dramatically reducing the uncertainty budget and filling a crucial gap in the current measurement systems to have a more accurate understanding of what’s actually occurring within the gas pipeline.

Errors in fiscal measurements of flow

The Sarbanes-Oxley compliance requires accounting for errors in fiscal flow measurements of natural gas.3 While unexpected liquids events in dry gas systems can significantly inflate the uncertainty budget, it has been observed that these events normally leave behind solid material that has been swept up in the liquid flow. This solid material remains in the flow metering station as a permanent reminder of the liquid event and causes two main issues:

) Dry gas meters can read up to 2% in error when liquids are present. A process camera can confirm single-phase gas flow.

) Solids carried by liquid flows can accumulate on the pipeline floor, reducing its diameter in metering stations, just a small depth (<1/8 in.) can result in 0.3% errors, which is significant given the overall fiscal measurement uncertainty target of <0.5%.

These factors highlight the need for regular visual inspections and make them crucial for accurate fiscal measurements.

Cost of pigging and disposal of contaminants

Traditional pigging costs for a 30 mile section can range between US$2.5 million - 3.3 million, making it a costly and risky operation.

Using process cameras to monitor contamination ingress can reduce the risks associated with pigging and optimise its frequency. This can also lead to reduced methane emissions from venting at the pig launcher and receiver.

Pipeline corrosion

Internal corrosion

Liquid accumulation in pipelines poses a significant risk of internal corrosion, which can lead to catastrophic incidents such as pipeline ruptures. An example of this was the Carlsbad, NM incident, caused by the failure of a ‘drip’ separator designed to collect stratified flows of liquid.4 In this case, solid material had also been conveyed by the liquid and accumulated, blocking 80% of the cross-sectional area. This led to further liquid accumulation in the pipeline and ultimately to significant internal corrosion that caused a rupture and a fatal incident. Monitoring pipelines for liquid carry-over is crucial for identifying risks such as mist or stratified flows, which cause such failures.

External corrosion

Underground pipelines are commonly safeguarded against external corrosion through cathodic protection (CP) systems. These systems use a small DC voltage between the underground pipe and a sacrificial anode. An isolating joint separates the underground and above-ground sections to ensure the system’s effectiveness. However, the presence of contamination in the pipeline breaches this isolating joint. Being electrically conductive, these solids compromise the effectiveness of the CP system, increasing the risk of corrosion for the pipeline.

Conclusion

In summary, there are critical gaps in the traditional methods for monitoring and managing gas flows, particularly in detecting liquid carryover. The cost of these gaps is immense, with failures leading to losses ranging from US$250 000 - 250 million, as indicated by surveys from Amine Experts and the UK Health and Safety Executive.1,2 These shortcomings impact not just fiscal measurements but also operational efficiency and safety, including compressor damage and pipeline corrosion.

The use of process cameras are emerging as a gamechanging technology that provides real-time visual insights into pipeline activity, revealing issues like phase separator and filter performance that would otherwise go unnoticed. These cameras offer a solution to multiple challenges – from validating metrics like calorific value and flow to alerting operators of conditions that may result in costly failures or breach API and ISO standards. By filling these gaps, process cameras not only mitigate financial risks but also enhance operational efficiency, safety and asset integrity.

References

1. Trends in Tragedy – An in-depth study of Amine system failures, Amine Experts.

2. Hydrocarbon Release – dry gas seal integrity survey report – Offshore Technology Report 2000/070.

3. Gas Measurement Has Key Role In Sarbanes-Oxley Law Compliance, Tim Nesler, EMS Pipeline Services, Houston, TX.

4. Pipeline Accident Report Natural Gas Pipeline Rupture and Fire Near Carlsbad, New Mexico 19 August 2000.

14 World Pipelines / APRIL 2024

Phanindra Kanakamedala and Greg Morrow, Emerson, USA, consider leak detection, risk mitigation and tightening regulatory environments.

With the industry’s ever-tightening leak detection and rupture mitigation requirements, regulators are recommending the use of advanced technologies for oil and gas companies to manage their operations safely and profitably. The risks of not having critical data when needed are becoming too great for operators of gas and liquid pipelines and storage facilities.

The latest round of PHMSA’s ‘Mega’ rulings is only one part of a new regulatory landscape unfolding in the US and globally. The emphasis now is on the continuous monitoring of pipeline integrity, and facilitating early detection of anomalies that could indicate a leak or the potential for rupture.

Leak detection and pipe

Occurrences of leaks and major ruptures are rare, as pipeline systems and networks remain the safest, most economically sound method of transporting energy resources. Historically, leak detection and containment were not as high of a priority for some gas distribution, transmission and gathering pipelines, and hazardous liquid pipelines, as they were being developed.

Earlier pipeline systems were built according to the standards of their time, with more or less robust safety measures. Most of those systems have made marked improvement in safety measures –particularly liquid pipelines – undergoing retrofitting and upgrades to improve safety and comply with regulations. As high-consequence areas (HCAs) have been redefined and expanded, more and more pipelines need to meet higher standards to achieve safety, match industry best practices, and meet regulatory requirements.

‘Mega’ prism: gaps in leak detection

PHMSA stipulations impact many US onshore gas transmission and hazardous liquid pipelines, regardless of size or location. Safety and reporting requirements now extend to more than 400 000 miles of

15

Figure 1. Population centres worldwide have been built on top of existing gas pipeline networks, creating a series of high consequence areas (HCAs) that require continuous monitoring.

gas gathering lines. Of note are the tens of thousands of miles of previously unregulated pipe under federal governance.

The federal agency’s management of change (MOC) definitions have been broadened concerning “significant changes that pose a risk to safety or the environment.” This type of regulatory vocabulary can be viewed as a prism for contemporary alignment, reflecting growing concerns around pipeline integrity management and safeguarding population centres, as well as ties to public perception, reputation management, and the clean energy future paradigm.

Industrial manufacturers such as Emerson have been developing technologies to satisfy legal requirements and corporate responsibilities, exceeding mandates for current leak and rupture detection, and addressing pipeline operators’ needs through these evolving lenses. A highly collaborative effort between manufacturers and end users is paramount to ensure technologies remain aligned to the latest industry requirements.

The international governing bodies tend to take cues from American-recommended practices with NTSB, API and GPSA standards often being a measure applied for many companies. Gas pipeline operators are anticipating accelerated growth in regulatory activities and strict non-compliance penalties on both state and federal levels. This is occurring in tandem with a global emphasis on emission reductions and emerging opportunities in the hydrogen and carbon dioxide pipeline market sectors.

All the new rules and their ramifications are providing a global forum for proactive dialogue that centres on addressing the leak detection and mitigation valve installation needs and challenges. It is becoming clear that leak and rupture detection technology guidelines on state and regional platforms could exceed federal requirements, and there is room for greater collaboration to identify the potential for any gaps head-on.

A new degree of urgency

Any high-pressure or volatile fluid could, and should, be contained and regulated to the right degree. The Mega Rule and the probability of future pipeline legislation add a new sense of sense of urgency and ‘meat to the bone’.

For some pipeline companies, this involves implementing leak detection systems where they might not have existed before, conducting integrity assessments for the whole pipeline, and enhancing emergency response plans for entire or continuous systems. This is particularly true for the clean energy future.

The US federal government is aligning the ongoing leak detection and mitigation conversation squarely with efforts to uphold the public’s trust, at the same time weighing the cost and benefits around the proposed new development of critical oil and gas pipelines and blended energy infrastructures.

As repair mandates are determined by leak severity with requirements for operators to act quickly to protect people and mitigate the release of emissions, the rules additionally provide latitude and options for pipeline companies to implement innovative and readily available technologies.

A 1Q24 written testimony of a PHMSA deputy administrator before the US House of Representatives Committee on Energy and Commerce reflects how the government is doubling down on the regulatory and environmental perspectives. Accessing leak detection and rupture mitigation capabilities amid new energy

transportation and product storage infrastructure solutions on the horizon are being unambiguously identified as a critical link:

“The Notice of Proposed Rulemaking (NPRM) updates decades-old, federal leak detection and repair standards are in favour of new requirements that add an additional layer of safety by deploying commercially available, advanced technologies to find and fix gas leaks that previously may have gone unrepaired in perpetuity.”

New leak detection enforcement mode

In 1Q24, PHMSA was tracking a dozen active hydrogen pipeline research projects, reflecting approximately US$11 million in research investments. The concern is how to safely transport and store hydrogen and hydrogen blends by repurposing existing infrastructure used for natural gas transport and underground storage and improving hydrogen leak detection.

At least four projects were actively being used for the determination of impact areas related to the safe operation of CO2 pipelines, including the probable impact radius for carbon dioxide, innovative leak detection methods, material testing and qualification for repurposing pipelines and underground storage facilities for CO2 transport and storage.

PHMSA, citing its investigation and enforcement activities involving the 2020 pipeline rupture in Satartia, MS, has made CO2 pipeline regulation a top priority, noting an intention to issue a Carbon Dioxide and Hazardous Liquid Pipeline Safety NPRM this year. This incident in Mississippi has opened another door for government intervention to ensure compliance with industry best practices, similar to the 2010 San Bruno, CA natural gas and Marshall, MI crude oil pipeline events, which ultimately became trigger points for some NTSB recommendations now being implemented.

In 2021, 2022 and 2023, PHMSA announced that it set records and last year alone issued over US$12.5 million in proposed civil penalties against operators who did not comply with safety regulations.

Moreover, on the state level, with Colorado as just one example, they appear to be following suit on stern regulations and strict penalties for gas pipeline operators on leak disclosures and line locations. It was reported that new rules in the state were set to double the maximum civil penalty per violation to US$200 000 for non-compliance.

Faster response, complete isolation

Among notable Mega Rule provisions are requirements for identifying pressure loss and the need for rapid response to gas pipeline ruptures and leaks. The rules specify criteria for the installation of remote-control or automatic shutoff valves, or equivalent technology, at strategic locations and other requirements to ensure affected gas pipeline sections can be completely isolated.

Operators are required to identify ruptures – and close valves to isolate the ruptured segment as soon as practicable –not exceeding 30 minutes from rupture identification. Criteria and levels of complexity differ and may include situations where there are unexplained liquid or gas flowrate changes due to an equipment function, any large release of gas, a fire or explosion in the near vicinity of the pipeline, amid other variables.

16 World Pipelines / APRIL 2024

IT IS MY DEDICATED PASSION

for pipelines that compels me to partner with others in the industry, share best practices and collaborate on ideas for future innovations and advanced applications.

It is who I am. I am a pipeliner.

We are pipeliners too.

We share this passion and, like you, we are committed to keeping pipelines running safely and reliably. By providing top-of-the-line tools to address your threats, and applying the most advanced assessment techniques, we ensure you get the best return on your pipeline asset, both economically and environmentally.

The world counts on you. You can count on us.

Coming to PTC?

Stop by and see us at stand C14

Scan here for a preview of our presentations and more info about our show presence.

T.D. Williamson

©2024

Is it limited to one location? Are multiple locations impacted? Is it an outage situation? How can leaks be detected and locations pinpointed more strategically and effectively, expediting a response to mitigate the impact of pipeline ruptures?

Among the primary concerns is what’s next on the horizon for monitoring and detecting leaks and mitigating ruptures. How many rupture-mitigation valves (RMVs) are necessary? What factors must be considered when determining where and how far apart they should be located?

Leak surveillance, penalties for oversight Strides have been made in technologies linked to strategies for recurrent leak surveillance, including how government access to satellite imagery could be readily available and used by regulatory bodies to monitor occurrences such as venting, unlit flares, and emergency release scenarios.

If a leak goes undetected between a company’s internal inspection milestones but picked up sooner by regulatory monitors, this can translate into heftier fines, and more cumulative penalisation. If an opportunity to proactively discover and more cost-effectively remediate a leak event is missed, they could be fined for the entire assumed duration of the leak. This is just one example of a regulatory occurrence that the use of the right leak monitoring technology could prevent or fix.

On the other end of the spectrum, pipeline ruptures require rapid response to protect lives, assets, and the environment, and limit impacts, while doing everything possible to maintain the public’s trust. If a breach occurs, the technology must accurately and reliably recognise it to ensure pipeline controllers can take confident action to rapidly remediate the situation.

The right detection, actual localisation Technology manufacturers are responsible for consistently emphasising the ability to detect and locate, leveraging sophisticated methodologies for identifying and analysing leaks and ruptures. The components and applications vary by oil and gas company, individual specifications, and requirements. One pivot point hinges on the ability of actual leaks or ruptures, not false alarms, to be discovered.

This must allow for operators to be alerted quickly so that a proper response can be facilitated before leaks result in stiffer penalties or situational unmanageability grows. Emerson’s PipelineManager software enables rapid detection and high sensitivity to both large and pinhole-sized leaks through statistical analysis and filtering techniques. These advanced capabilities enable companies to achieve more immediate and cost-effective remediation as any leaks can be identified and localised, faster.

Methods of leak, rupture detection effectiveness

Different methodologies for leak detection include those based on volume or mass balance versus direct instrument monitoring. PipelineManager software utilises both modelbased and non-model-based methods. This allows for the selection of the most appropriate technique based on engineering assessments.

The software offers advanced data reception and processing capabilities. Data are integrated from various sources such as flowmeters, pressure sensors, and temperature gauges, to construct a comprehensive real-time picture of pipeline operations. This integration allows for the continuous monitoring of pipeline integrity, facilitating early detection of anomalies that could indicate a leak.

PipelineManager software enhances rupture detection by analysing deviations in flow and pressure measurements, ensuring accurate identification under various operational modes such as pressure control, flow-control, shut-in, or slack conditions. Model-based methods are highlighted for enabling fast and accurate leak detection even in transient conditions. These methods are robust across various operational scenarios – used for low flowrate and product theft scenarios to enhancing rupture mitigation efforts.

PipelineManager software is based on modelling technology that provides pipeline leak detection and localisation, batch composition tracking, automated forecasting, facility planning and operator training, as well as multiple leak detection technologies to detect ruptures.

Deviation analysis and sophisticated statistical evaluation is employed by PipelineManager to differentiate rupture signatures from normal operational changes. Moreover, the software’s MAOP monitoring ensures operations do not exceed the safety limits for pressure, critical for preventing incidents. Built-in features enhance safety and operational efficiency via real-time data and alerts for critical parameters.

Operators can generate reports that are shared with authorities, satisfying auditing needs and demonstrating compliance with regulatory requirements. Real-time progression of corrosion and erosion monitoring from anywhere, and longdistance pipeline monitoring can also be set up.

A meaningful response

An integral piece of PipelineManager software is tied to improving alarm reliability and increasing operator confidence in an appropriate and meaningful response. The quality of input data here is central. Inconsistencies can result in more frequent false positive alarms, with operator fatigue and the potential for control room complacency both at stake.

18 World Pipelines / APRIL 2024

Figure 2. Advanced software with GIS capabilities provides control room operators with a clear view of a potential leak point.

HOW ABOUT A COATING WITH A 60 YEAR LIFETIME?

STOPAQ is a purpose designed sustainable coating solution in order to comply with our future reality.

The technology behind STOPAQ is referred to as visco-elastic. However, viscoelasticity is the behaviour of the polymer used.

STOPAQ is at heart a Polyisobutene (PIB) based coating. This polymer creates an impermeable barrier to oxygen and water and doesn’t cure over time. This leads to permanent adhesion to the surface, resulting in an extended lifetime of the coating and permanent corrosion prevention of the asset.

Designing coating solutions for a maintenance-free future.

Learn from the past Think of the future Learn all about our solutions and their maintenance benefits in our new podcast series: www.stopaq.com/news

Self Healing Corrosion Prevention & Sealant Technology

Leak detection, risk mitigation

Pipeline companies stand at a critical juncture, balancing calls for more robust gas pipeline safety and security prerogatives that are in step with emission reduction goals and the ability to meet rising global energy demands. The development of many mainline gas pipelines in the US occurred more than 60, or even 80, years ago. A few Civil War-era gas distribution segments still exist – that’s over 150 years in the ground.

The selection of the appropriate methodology is more of an engineering assessment, considering performance criteria, cost and instrument availability rather than a proving exercise for a particular leak detection technology.

The aim is always to ensure that leaks are discovered and repaired before they can degrade into more serious ruptures.

Overcoming future leak detection complexity

PipelineManager software enables pipeline companies to sustain high-performance levels with its demonstrated ability to be highly effective in detecting leaks incisively and with minimal false alarms. It can alert on ruptures during events that typically hinder other systems, like pump trips and flow starts. It also reduces sensitivity to transient effects and adapts to various conditions.

It additionally accounts for data from a SCADA system and performs real-time transient modelling using a fully thermodynamic, first principles physical model (a digital twin of the pipeline) to determine if a leak has occurred.

Proposed rulemaking around advanced leak detection programme (ALDP) performance standards and requirements underscore realities, bringing those associated with establishing minimum standards for evaluating criteria for leak grades and repair schedules that much nearer. There will be vital impacts as they decide how to approach regulations with natural gas, hydrogen and CO2 pipes each at the forefront of a safe and clean energy transition narrative.

When it comes to peeling back layers to identify any potential gaps in strategic leak detection and rupture mitigation strategy and the implementation of an optimal technology, proactive action is the greatest shield against ambiguity or uncertainty.

www.iploca.com/events

2024 SORRENTO, ITALY

Figure 3. Emerson’s PipelineManager software uses statistical analysis and filtering techniques to ensure leaks can be quickly identified and localised.

9-13 September

EVALUATION OF GROWING CORROSION

Fadillah Syahputra, Zugao Chen and Tim Zhang, Deyuan Pipeline Technology Co., Ltd, China, describe detecting internal corrosion

defects through eddy current inline inspection technology across China’s W shale

gas field pipelines.

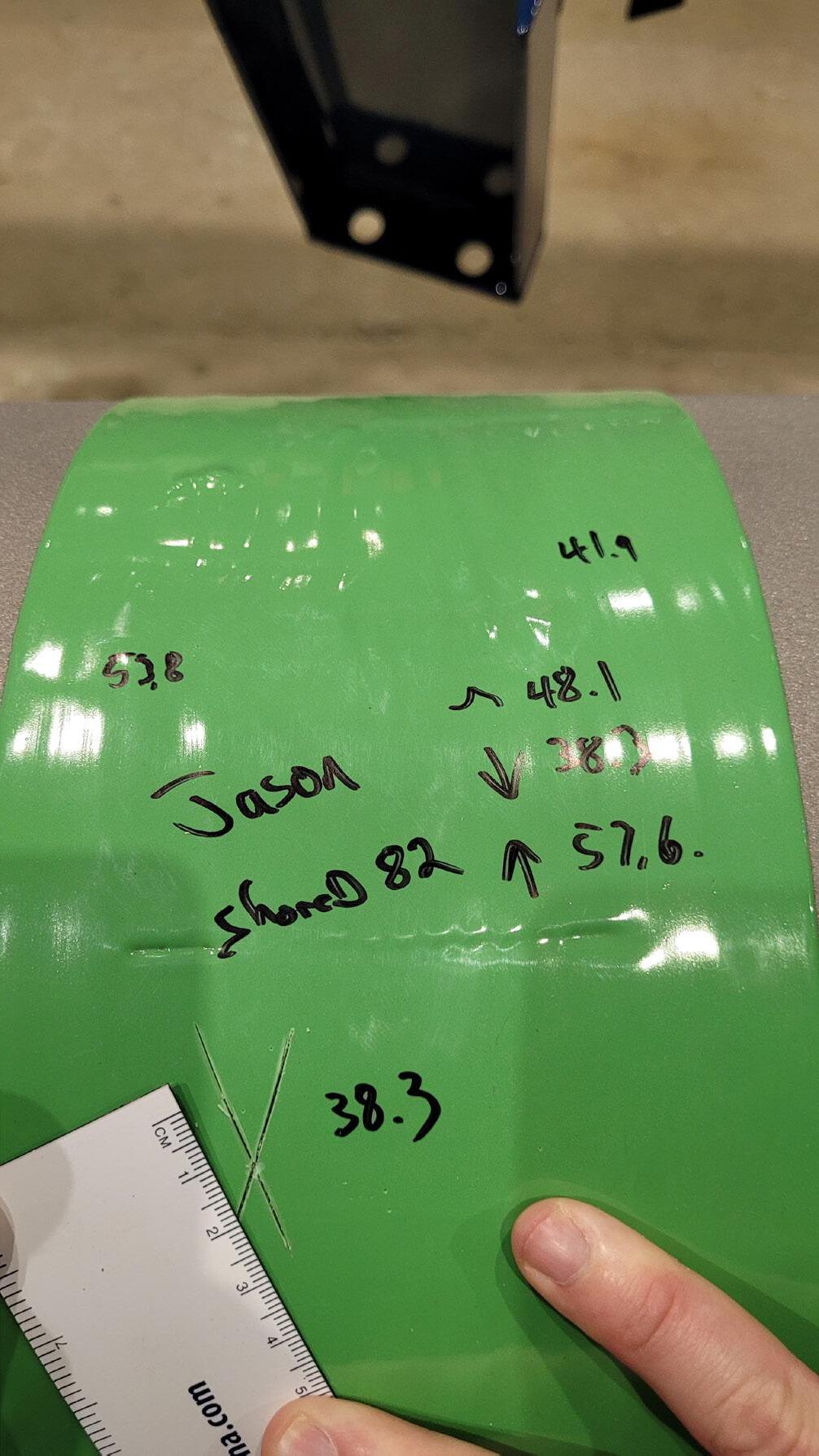

In the challenging terrains of Southwest China’s W shale gas field, several natural gas gathering pipelines ranging from 8 in. - 20 in. were constructed with significant elevation changes and numerous bends, with a minimum bend radius of 1.5D. The medium inside these pipelines, comprising water-bearing shale gas, introduces internal corrosion as a fundamental challenge to the gas field’s pipeline system. It is well known that microbiologically influenced corrosion (MIC) and CO2 corrosion are the common types of corrosion in shale gas fields. To ensure the safe operation of shale gas pipelines, it is crucial to monitor the trend of internal corrosion growth, understand the corrosion growth rate, and assess the effectiveness of existing corrosion control measures.

Over 70% of the pipelines in this gas field are equipped with pigging valves for launching pipeline cleaning devices, such as foam pigs and mandrel pigs with or without wire brush. With the given low daily gas throughput in some pipelines, selecting internal inspection technologies compatible with pigging valves presents a challenge for the pipeline inspection engineers. The PIGPROX inline inspection (ILI) technology utilises patented eddy current sensor technology. This ILI technology is specifically designed for detecting internal corrosion defects. The PIGPROX design resembles that of a cleaning pig, characterised by its short length, light weight, and flexible navigability, making it compatible with pigging valves for easy deployment.

21

Figure 1. PIGPROX eddy current tool launch via pig valve.

PIGPROX ILI operation

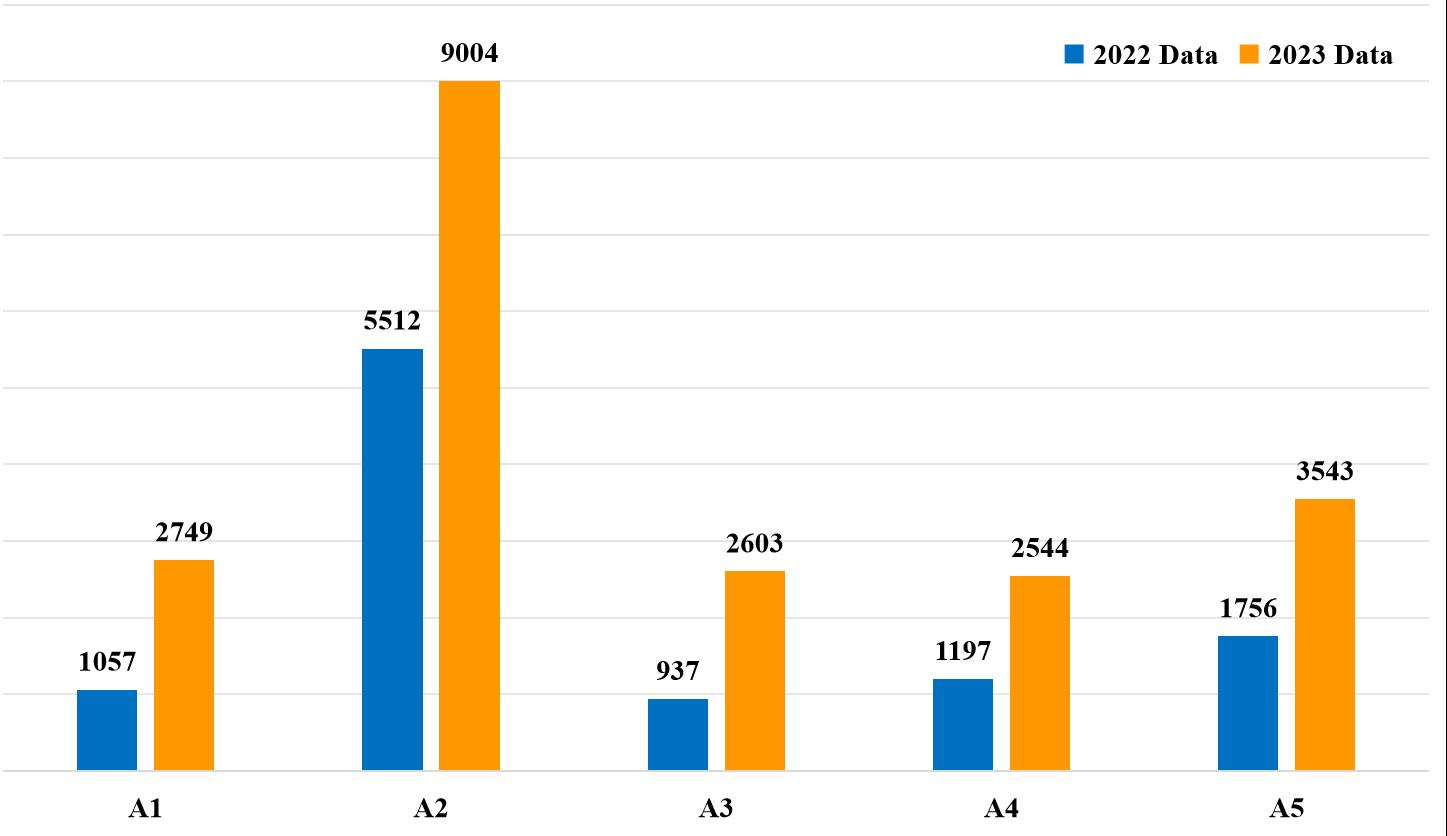

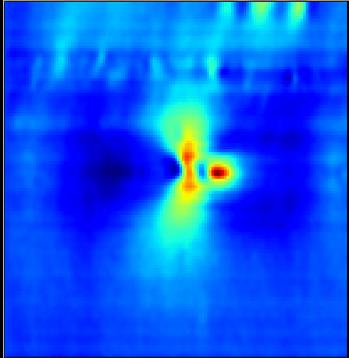

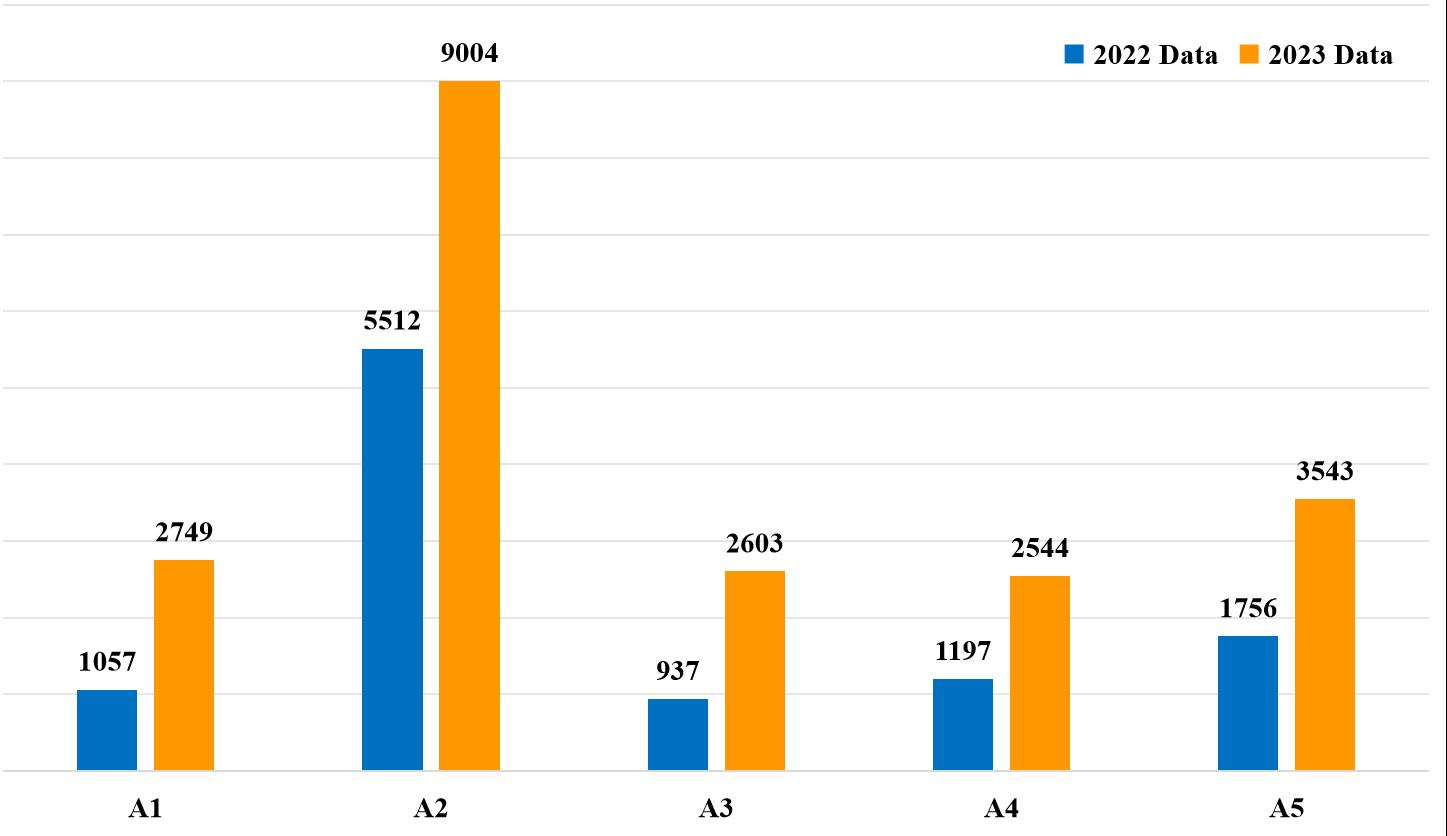

The five shale gas lines shown in Table 1 were inspected two times by PIGPROX ILI tools in 2022 and 2023.

Among these five shale gas pipelines, three pipelines utilised pigging valves for launching, whilst the other two pipelines utilised the standard pig launching barrels. The pipeline with the highest average operational velocity reaches

up to 3 m/sec., whereas the slowest operates at 0.48 m/sec. The inspection was successfully conducted on all these pipelines, with the first run success rate of 100% and collected good quality data of high signal to noise ratio.

ILI data outcome in 2022 and 2023

Number of defects analysis

The number of internal corrosions detected in 2023 indicated a significant increase, with the growth of new defects ranging between 63.4% and 177.8%. This phenomenon highlights that the growth of internal corrosions has escalated on these inspected pipelines.

Startling internal corrosion growth

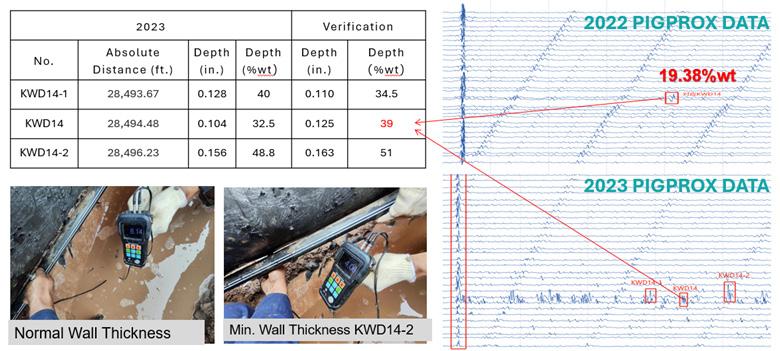

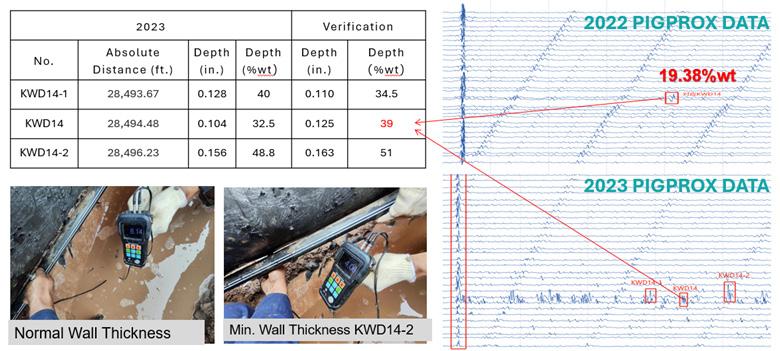

Taking A2 pipeline as an example, we did a run comparison of the PIGPROX eddy current inspection data between 2022 and 2023. The analysed data in 2022 and 2023 revealed a significant finding at the distance of 8685.118 m. The result of the PIGPROX inspection in 2022 identified a defect with a depth of 19.28% wt, which, by the 2023 inspection, had grown to 32.5% wt. Upon excavation activities, the actual measured depth of the defect was verified to be 39% wt, indicating nearly a 20% wt increase in depth. In addition to the existing internal corrosion growth, a number of new defects were detected and identified near this location in the 2023 inspection. For example, the internal corrosion at the 8685.651 m mark was a new defect but it had reached a depth of 51% wt, as detailed in Figure 5.

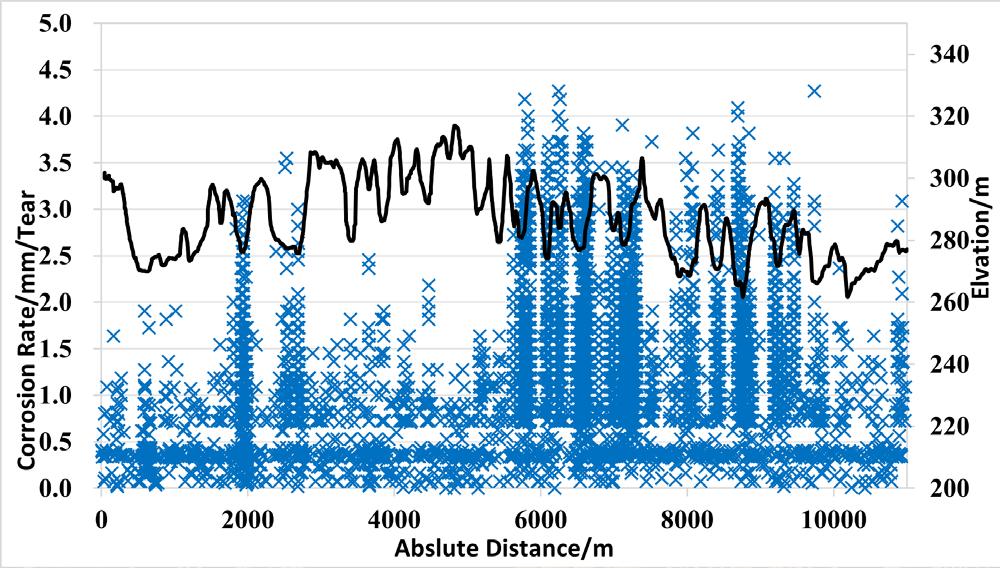

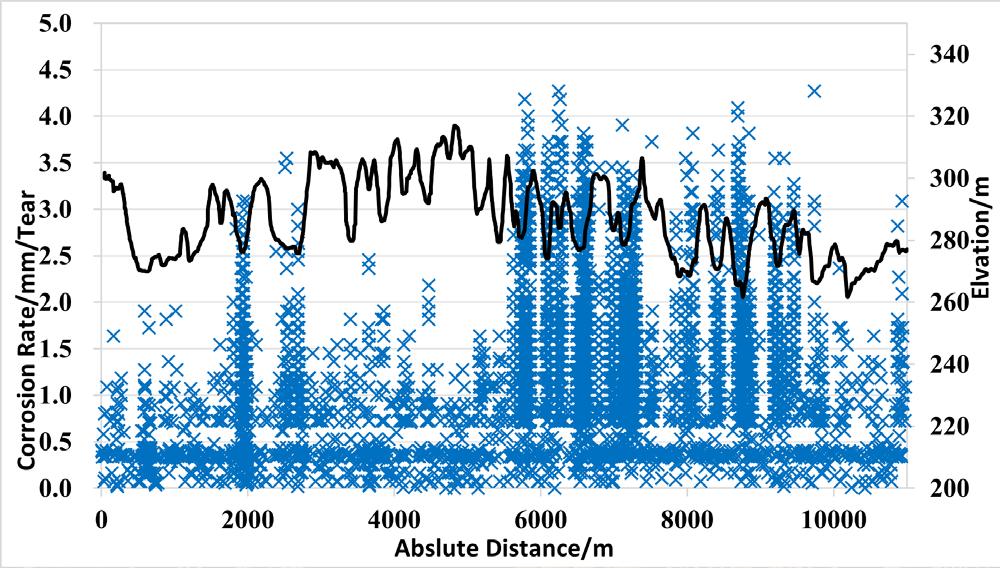

Internal corrosion and pipeline elevation analysis

The growth of internal corrosion in these five pipelines is closely linked to the accumulation of residual fluids from the existing transported product, exemplified by the A2 pipeline. An overlay and alignment analysis of internal corrosion defects with the pipeline’s elevation (as detailed in Figure 5) reveals that:

) Internal corrosion defects show a significant concentration trend at the lower elevation sections and uphill liquidholding segments of the pipeline.

) The internal corrosion growth trend within these low-lying areas and uphill liquid-holding segments is pronounced, with a faster growth rate compared to other sections of the pipeline, as evidenced by a comparison of inspection data from 2022 and 2023 (Figure 6 gives detailed analysis).

By integrating internal corrosion defect data with elevation data, an in-depth analysis of the pipelines of W gas field were performed and it was emphasised that the tendency for residual product accumulation is higher in low elevation sections and orientation, between the 4:00 and 8:00 positions. This localised accumulation fosters a conducive environment for the proliferation of microbial and bacterial colonies, significantly contributing to the accelerated progression of internal corrosion growth within these segments.

Figure 2. Internal corrosion defects located at the spiral weld zones.

Figure 3. PIGPROX site operation.

Figure 4. Statistics chart of defects in 2022 and 2023.

Name Outside diameter Wall thickness Length 2022 inspection date 2023 inspection date ILI days interval A1 10 in. 0.279 in. 3.50 miles 6 July 2022 24 November 2023 506 A2 12 in. 0.312 in. 6.86 miles 7 October 2022 29 November 2023 418 A3 12 in. 0.312 in. 5.81 miles 3 October 2022 23 November 2023 416 A4 10 in. 0.279 in. 2.93 miles 6 July 2022 22 November 2023 504 A5 20 in. 0.438 in. 3.1 miles 22 July 2022 29 November 2023 495 22 World Pipelines / APRIL 2024

Table 1. Inspection dates of 2022 and 2023

There’s nothing quite like welding onto a live pipeline In this high-stakes operation, product flow affects heating and cooling, making proper planning and execution a must. Without it, your pipeline’s long-term integrity is at risk.

WeldFit’s API 1104-qualified welders average a decade in the industry, so they get the job done right. And they’re backed by simulation and real-world testing, ensuring they’re following the most appropriate procedures to reduce pipeline threats. When it’s not just another weld, choose WeldFit. Contact your WeldFit representative to learn more.

WeldFit.com/ISW

TM Trademark of WeldFit Corporation in the United States and other countries. © Copyright 2024 All rights reserved by WeldFit Corporation

ANOTHER

For In-Service Welding, Expertise Matters. Qualified / Reliable / Safe

NOT JUST

WELD.

Circumferential distribution of internal corrosion

Figure 9 shows the orientation of the internal corrosion distributed from 4:00 to 8:00.

To summarise

Throughout 2022 and 2023, the extensive application of PIGPROX eddy current inspection technology in the W shale gas field’s gathering pipelines yielded some significant data to clients on the growth of the internal corrosion defects. Integrity engineers have analysed this data and, in response, they have enhanced the safety and operational integrity of the pipelines by increasing pigging frequency, selecting more effective corrosion inhibitors, and finetuning microbial corrosion control strategies. These adjustments have effectively slowed down the progression of internal corrosion. Since the implementation of the PIGPROX internal inspection in the shale gas field in 2022, there have been no occurrences of pipeline failures or gas leaks caused by internal corrosion. PIGPROX ILI technology has provided the scientific and test results to ensure its safe operation.

PIGPROX eddy current ILI technology has proven to be indispensable in inspecting pipelines with low flow and low pressure, as well as those pipelines which are equipped with pigging valves. It delivers the quality of the collected data by providing accurate, efficient internal inspection capabilities, and pioneering solutions for pipeline integrity management system.

Future directions

The widespread deployment and detailed examination of the PIGPROX eddy current ILI technology across the W shale gas field’s collection pipelines have yielded an abundance of insights, significantly enhancing pipeline integrity management strategies. As the oil and gas sector confronts the everincreasing complexities and challenges in ensuring pipeline integrity within such demanding environments.

The innovative technologies like PIGPROX provide not only effective solutions for ensuring the safety and efficiency of pipeline operations but also it becomes a foundation of ongoing advancements in the field. The emphasis of inspection technologies is expected to shift towards better technological innovations, more sophisticated yet efficient data analytics capabilities, and more cohesive pipeline integrity management frameworks.

These advancements aim to tackle the dynamic challenges associated with pipeline corrosion and overall integrity management. Enhanced data analytics, in particular, will play a pivotal role in this evolution, offering deeper insights into corrosion patterns, pipeline wear and tear, and potential failure points. This, combined with integrated integrity management systems, promises a more proactive approach to maintaining pipeline health, optimising maintenance schedules, and minimising the risk of unscheduled downtimes or catastrophic failures. Such technological and methodological advancements are essential for the oil and gas industry to adapt to the increasing pressures of environmental sustainability, regulatory compliance, and operational excellence in a landscape marked by rapid technological evolution and heightened global competition.

Figure 5. The No. KWD14 defect growth.

Figure 6. Absolute distance, corrosion rate and elevation distribution diagram.

Figure 7. Comparison and elevation distribution of inspection defects in two rounds of A2 line.

24 World Pipelines / APRIL 2024

Figure 8. Circumferential distribution of internal corrosion of A2 line.

Simon Bell, iNPIPE PRODUCTS, UK, discusses acoustic reflectometry technology as an interesting remote technique to detect full or partial blockages within a live gas pipeline or an empty pipeline during construction.

Inspection of pipelines and the development of various technologies goes back to the 1950s and early 1960s with regard to metal loss, corrosion and crack detection which are widely accepted as areas of most concern. Metal loss surveys broadly fall into three basic methodologies including magnetic flux leakage, ultrasonics and eddy currents, which are typically carried through the pipeline as sophisticated pigs.

The overall diameter of the pipeline is equally important to understand as deposition may occur in various tipping points over the lifetime of the asset.

25

Product flow and chemical makeup may vary over time, which may also have an influence on temperature, and lead to unwanted depositions within the pipeline. Similarly, the effective operation of valves may also be impacted upon over time and there is always the potential for accidental mechanical damage to be considered.

Pipeline blockage detection system

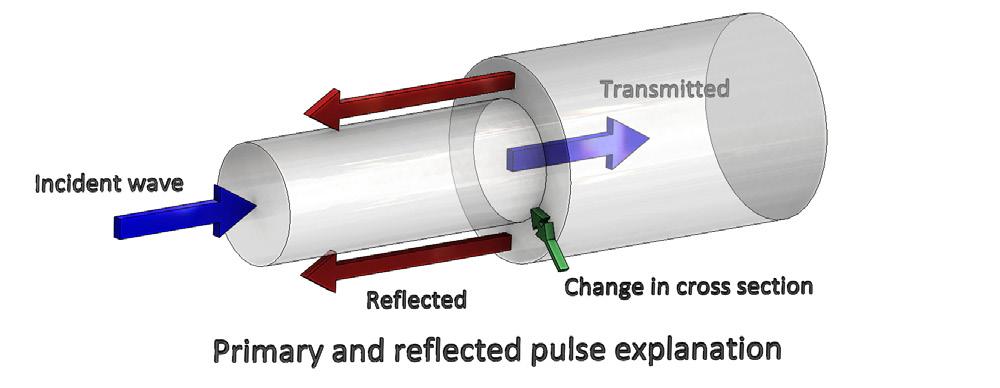

Acoustic reflectometry technology has developed into an interesting remote technique to detect full or partial blockages or obstructions within a live gas pipeline or indeed, simply an empty pipeline during construction. The apparatus is simple to use, easily transportable and quick and easy to connect, typically through an existing 0.5 in. connection. This means that it can be mobilised in a short space of time when the need arises; there is no disruption to gas flow or normal production operations and complex pipeline networks can be easily accommodated and inspected quickly.

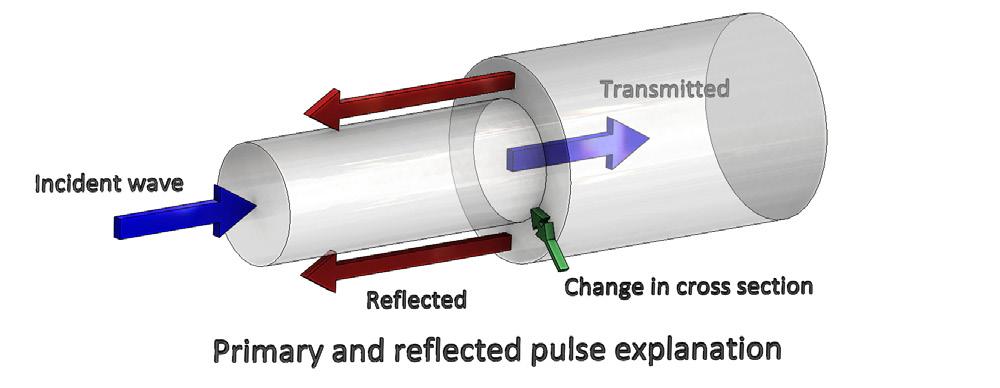

In simple terms, the Acoustek system injects an acoustic pulse, or pressure pulse into the gas pipeline. The pulse travels along the pipeline as a plane wave and any acoustic impedance will partially reflect the pulse. In this way, it is possible to detect reductions in bore potentially caused by mechanical damage or debris build up by measuring the reflections produced; such reflections, together with the knowledge of the speed of sound within the pipeline, allow for the location of feature, such as blockages, holes, valves and buckles, to be accurately detected and located. The technique is totally non-invasive and is equally applicable to small and large diameter pipelines. As the technology is noninvasive it is particularly helpful when used to detect and accurately locate blockages caused by stuck pigs or isolation tools and is accurate to +/- 2.5 m over a 10 km distance. Longer distances can be inspected by disconnecting the equipment and simply moving further down the pipeline and then reconnecting. One of the greatest benefits of the system is that it provides real time, instant analysis which is particularly important in the case of stuck pigs.

Methodology

Ever increasing demand within the global energy market, together with reducing reserve opportunities for onshore or shallow water has led to an international trend towards developing deeper and deeper water reserves. Deep water flow lines across the seabed increase the risk of hydrate formation dramatically and is a major challenge with regard to flow assurance. The oil and gas industry spends a large amount of energy and money in combating the formation of hydrate deposits within natural gas pipelines. It therefore follows that early detection of potentially developing hydrate blockages is very important so that effective remedial actions can be developed and planned.

Figure 1. Acoustek blockage detection system connected to the pipeline.

Figure 2. Primary and reflected pulse illustration.

26 World Pipelines / APRIL 2024

Figure 3. Data analysis via laptop software.

Critical to the remedial activities are the location, identification and removal of the obstruction and the accurate evaluation of the blockage is fundamental to the successful completion of this process. Conventional methods traditionally adopted for blockage detection include radiographic methods, flow pressure monitoring detection and diameter expansion methods.

Flow pressure monitoring detection uses pressure wave propagation to remotely detect blockages. A quick acting valve is used to generate a shock wave inside the pipeline and records any reflections generated by any blockage. This method has been proven to detect blockages over long distances with reports of up to 100 km. The speed of sound and potential noise interferences may affect the results and potentially give rise to errors. This method consequently has some limitations as it requires the flow line to be temporarily shut down for a short period of time to create the necessary pressure wave. The pressure wave leads to water hammer upstream of the closing valve together with cavitational hammer downstream of the valve which may unfortunately cause damage to the pipeline itself and also the supporting structure. This potential for damage to

the pipeline is not normally acceptable to some pipeline operators.

The pipeline diameter expansion variation measurement method can be used to locate a blockage and calculate the length of the blockage with a high degree of accuracy. By pressurising and then depressurising

Figure 4. Typical site installation.

Figure 4. Typical site installation.

the pipeline a measurable diameter expansion would be created throughout the pipeline if it were free of any blockage. Assuming no expansion is detected then the blockage must be considered to be located between the source and the measuring point. In deep water, this method requires the use of a remotely operated vehicle (ROV), and the approximate location of the deposit needs to be known in advance. Similarly, a major disadvantage is that it cannot be used if there is no direct access to the pipeline, as in the case of buried pipelines.

The radiographic method of detection uses the ability of short wavelength electromagnetic radiation to penetrate various material and is quite accurate when used for short distance inspection. The equipment is typically mounted on an ROV, but the detection ability is affected by the surrounding material of the pipeline, like concrete structures.

Additional areas of application include validation of valve status including speed of operation and validation

of clear passable access which can be useful in providing health data on ESDV operation in order to assure conformance to HSE regulations. Reflectometry has also been successfully used to determine liquid levels in risers or liquid levels in tanks as required.

The simple but effective technology, which is very easy to deploy and rapid to interpret has a whole host of non-oil and gas applications in the water and sewage industry as it is simply providing data on an obstruction within a known volume and distance. Ideal for identifying the infamous ‘fatberg’ which accumulate from congealed fat and reinforced with wet wipes and nappies.

Similarly, there are numerous applications within the renewables industry the system can be usefully applied to check that the pipework and/ or ducts are clear prior to pulling through cables.

Case study – cable pull-through pig site operations

Historically, iNPIPE PRODUCTS have been involved in a number of onshore to offshore cable pull-through pigs and site execution for offshore windfarms. Typically a 12 in. NS HDPE pipeline required a 2 in. messenger wire threading through the 600 m long onshore to offshore pipeline prior to a 5 in. cable pull-through by the client.

The project required mobilisation of site personnel, cable pull-through pig, temporary pig launcher and equipment spread to a site. The pipeline was 12 in. NS in diameter x 600 mm long with numerous bends (size unknown).

Following the mobilisation of the personnel, temporary pig launcher and equipment on schedule, the operation was coordinated in conjunction with a third party on behalf of the end client.

On completion of the ground works and with the pipeline exposed and the temporary launcher/receiver installed complete with a pigging pump fitted, the cable pull through was good to commence. After the pigging of the metal bodied pig, which became lodged due to an unknown crushing of the pipeline, a special dual density foam pig was produced in record time to be on-site and able to run through the pipeline, but also able to negotiate a 45% pipeline reduction. The project, however, was completed successfully and ahead of budget. Acoustek technology now allows for pigging contractors to accurately locate lodged pigs and discuss remedial operations.

References

1. SLOAN, Jr, E.D., ‘Fundamental principles and applications of natural gas hydrates’.

2. WANG, X., SHORT, G., DAWSON, K., LENNOX, B, ‘Acoustic Reflectometry for Gas Pipelines’.

Figure 5. 14 in. x 12 in. temporary pig launcher onsite.

28 World Pipelines / APRIL 2024

Figure 6. 12 in. cable pull-through pig.

Luigi Kassir and Josh Pendleton, Skipper NDT, discuss the drawbacks of manual methods for detecting and locating abandoned pipelines and wells, providing a new solution system that combines several sensors to acquire precise magnetic data.

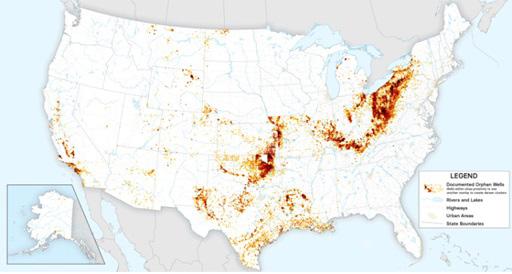

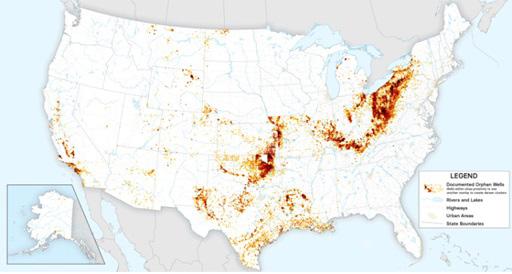

he US is home to over 2 million decommissioned or abandoned oil and gas wells, alongside thousands of miles of decommissioned or abandoned pipelines. Among these assets, some are classified as ‘orphaned’ due to a lack of identifiable owners.

These assets present a significant risk of emitting gases that contribute to safety and environmental hazards.

According to the United States Environmental Protection Agency (EPA), decommissioned, abandoned, and orphaned wells release an estimated

7 - 20 million metric tpy of CO2 equivalent.1

Compounding the issue, these decommissioned or abandoned assets often lack comprehensive records, posing challenges for midstream operators in verifying, mitigating, and avoiding them during other construction activities in affected areas.

The challenge

The primary challenge for operators, in ensuring the safe retirement of decommissioned wells and pipelines, is the verification or establishment of their locations. This challenge is

compounded by the fact that historical records for these assets are frequently incomplete or inaccurate, and the areas they occupy are often vast, remote, and challenging to access.

Traditionally, the detection and locating of abandoned wells have relied on manual methods, such as electromagnetic pipe locators. However, these methods are associated with several drawbacks:

) Field operator safety concerns: many wells are situated in difficultto-access areas, posing potential safety hazards for field operators.

29

) High cost: given the extensive surface areas that need to be covered, deploying field operators to survey the area is timeconsuming and may require significant logistical planning and resources.

) Low efficiency: the manual nature of detection, coupled with the limitations of available tools, results in a lack of guarantee in identifying all targets effectively.

The solution

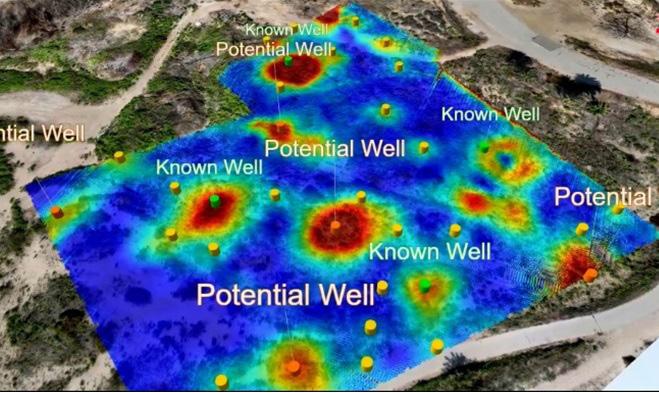

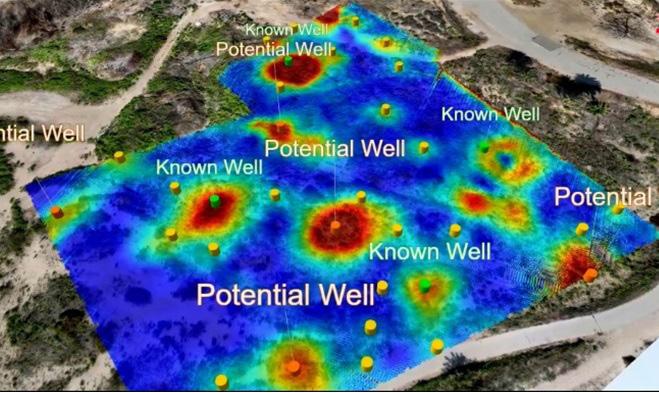

Skipper NDT offers a new technology, the Argos sensor system (Figure 2), that represents a paradigm shift to the efficiency of abandoned well and pipeline detection.

The Argos system combines several sensors to acquire precise magnetic data, free from interferences. Amongst these selected components are:

) Fluxgate magnetometers.

) Real-time global navigation satellite system (GNSS).

) Tactical grade inertial measurement unit (IMU).

) Remote sensors for measuring the distance the between the payload and the ground (for depth of cover assessment).

) A proprietary electronic card for data acquisition, digitisation, and synchronisation.

Among these sensors, fluxgate magnetometers play a crucial role. They can measure all three components of the magnetic field at a sample frequency of 1000 Hz. Compared to scalar magnetometers, fluxgate magnetometers have lighter and more durable sensors, and their sampling frequency is ten to a hundred times higher, making them better suited for UAS constraints.

An important advantage of fluxgate sensors is their ability to capture the 3D components of the magnetic field. Using this feature Skipper NDT has developed a proprietary protocol enabling to compensate any bias of the sensor allowing to increase the native resolution of the sensors 25 times.

By leveraging state-of-the-art hardware and software advancements, Skipper NDT’s Argos sensor stands as a fully automated magnetic-based technology, enabling the precise identification of abandoned wells and pipelines with a remarkable level of confidence and accuracy. The technology effectiveness has been demonstrated through rigorous field testing and validation across numerous abandoned well and pipeline detection missions conducted for leading operators in North America.

The notable advantages of our technology include:

) Remote operation: field operators can conduct scans remotely, eliminating the need to physically navigate challenging or inaccessible terrains, thus ensuring their safety.

) Swift coverage of large areas: through the drone vector, rapid access to complex landscapes, including mountainous regions is possible, enabling coverage of up to 20 acres per day. This capability significantly reduces time and resource expenditure.

) Real-time preliminary processing: the system enables quick preliminary processing of magnetic data directly in the field, facilitating operational responsiveness. Within just 15 minutes

Figure 1. Map showing documented orphaned wells.

Figure 2. Skipper NDT Argos payload on a commercial drone.

Figure 3. 3D rendering of the inspected site with a photogrammetry layer.

30 World Pipelines / APRIL 2024

Figure 4. 3D rendering of the inspection area with decommissioned pipelines and wells.

THE EXTRA MILE

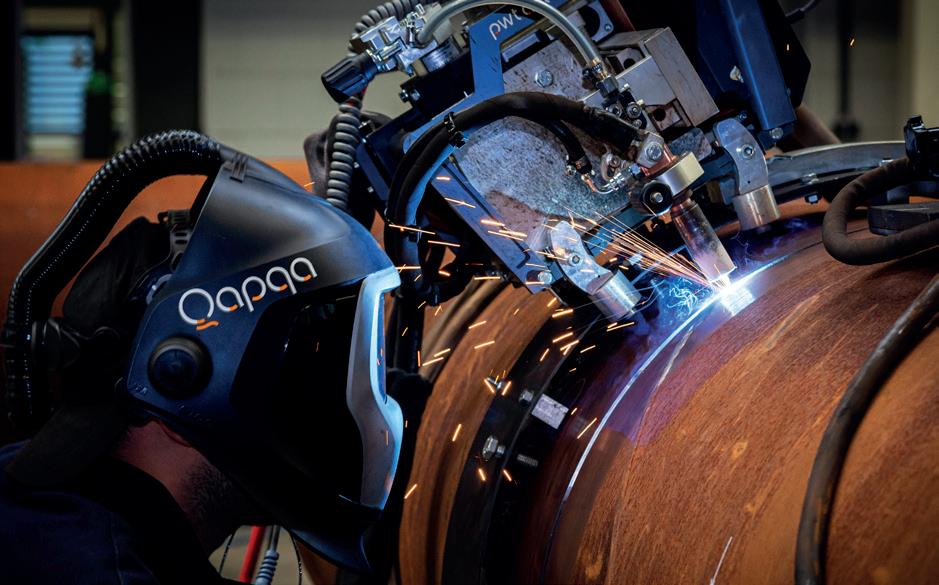

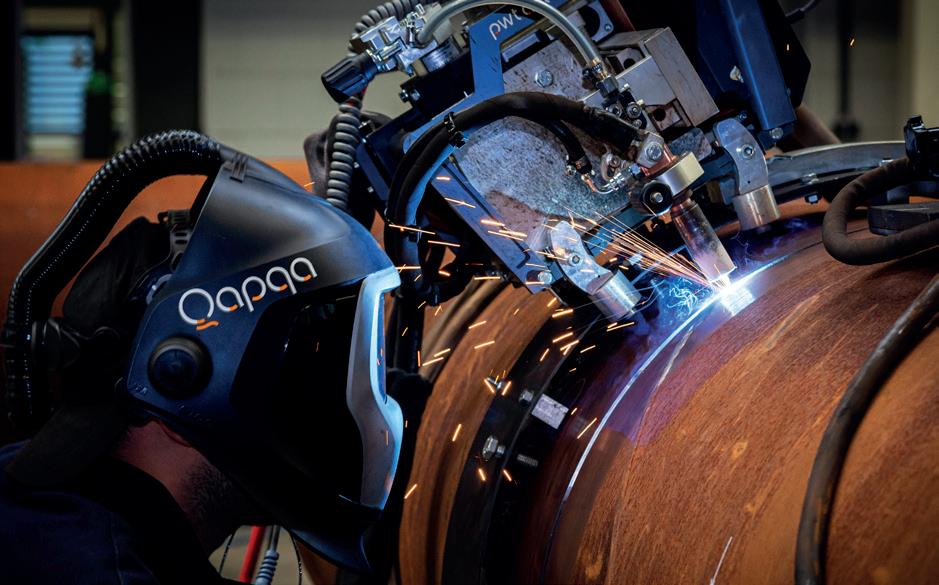

Qapqa is here to help you make your pipeline construction project to a success.

We not only provide egdecutting automatic welding technology, for fast and reliable welding. We are also a partner you can trust, who is there to support you.

As a family business, we think long term. Dedicated and continuously improving, we always challenge ourselves to go the extra mile.

In everything we do, we maintain the highest standards. Or as we call it: The Qapqa promise.

• Increase productivity

• Increase quality

• Lower repair rates

• High level of support

www.qapqa.com

after a drone flight, analysts can provide field crews with actionable insights.

) Consistent data quality: automated data acquisition and processing ensure reliable and repeatable results, enhancing the overall dependability of the solution. The proprietary data processing algorithms allow to distinguish wells and pipelines magnetic signatures from other sources of background noise.

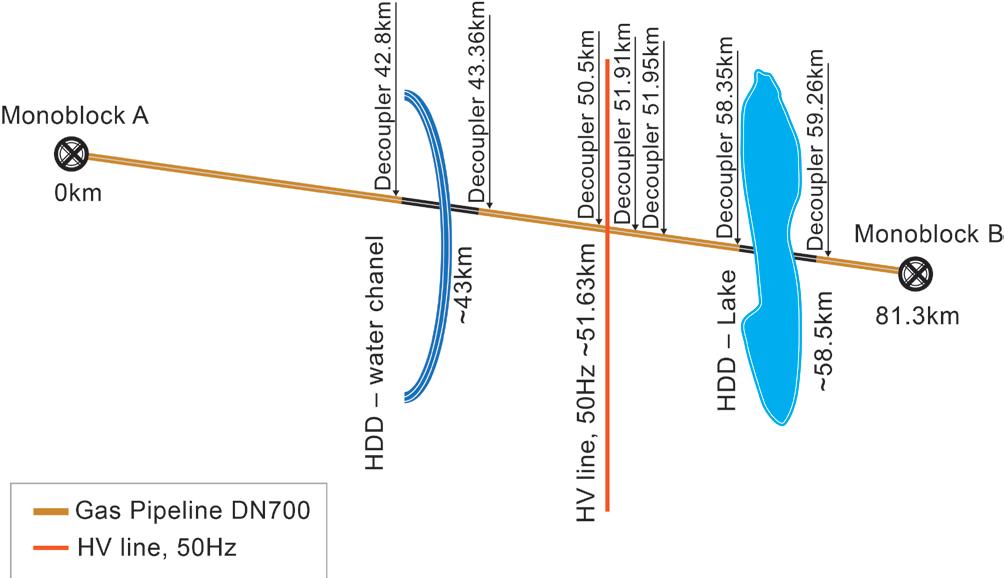

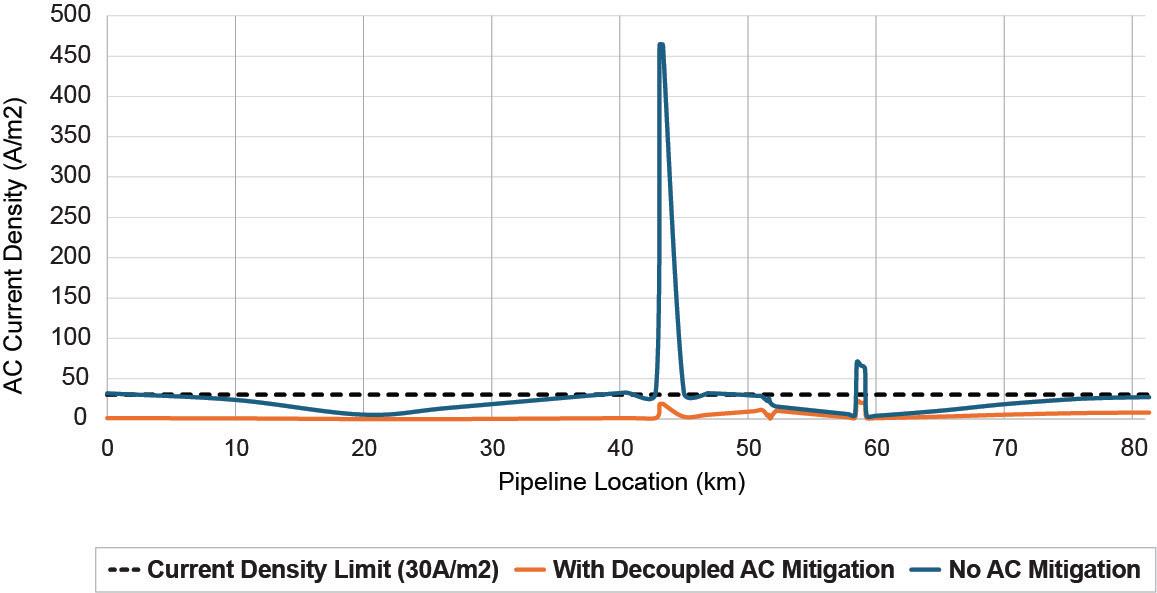

) Comprehensive geospatial positioning: Skipper NDT’s technology offers enhanced geospatial positioning by integrating additional data layers, such as photogrammetry or